UK Award Taxes

Even novice award travelers will notice quickly that taxes and fees for traveling out of the UK are some of the highest in the world. The reason behind this is the UK air passenger duty (APD). The APD is notorious in the award travel community as the culprit behind the high UK award taxes. But there is also quite a bit of misconception surrounding this levy, so let's look into how the tax works.

Table of Contents

ToggleWhat is the UK Air Passenger Duty (APD)?

Air passenger duty (APD) is a tax charged per passenger flying from UK airports to domestic and international destinations. The UK APD is notorious in the award travel community as the culprit behind the high UK award taxes.

The duty follows a band structure, where charged amounts vary by destination and class of service. The duty is set to increase on April 1, 2025, so we added the new pricing in parentheses:

| Destination bands and distance from London (miles) | Reduced rate (for travel in the lowest class of travel available on the plane for seat pitches less than 40 inches) | Standard rate (for travel in any other class of travel or where the seat pitch is more than 40 inches) | Higher rate (for travel in aircraft of 20 tons or more equipped to carry fewer than 19 passengers (i.e., private jets)) |

| Domestic | £7 (£7) | £14 (£14) | £78 (£84) |

| Band A (0 to 2,000 miles) | £13 (£13) | £26 (£28) | £78 (£84) |

| Band B (2,001 miles to 5,500 miles) | £88 (£90) | £194 (£216) | £581 (£647) |

| Band C (over 5,500 miles) | £92 (£94) | £202 (£224) | £607 (£673) |

Curiously, the distance is measured based on the distance between London and the capital city of your destination. It's also interesting that the “class of service” threshold is based on seat pitch.

When Does UK Air Passenger Duty Apply?

The APD applies to all flights originating in the UK regardless of airlines or destination. The only exception is for flights departing from Inverness (INV) in Scotland (yes, Inverness is part of the UK, but the Scottish Highlands and Islands are exempt from the UK APD).

Unfortunately, award tickets are still subject to this tax, regardless of which program you booked with. That is why you see higher taxes for flights departing the UK even with programs that do not pass on fuel surcharges, like Air Canada Aeroplan or United Mileage Plus.

So how do we avoid having to pay the APD when booking award flights? Since this is just a departure tax, the APD does not apply to flights to the UK. Nor does it apply to flights connecting in the UK.

This means you can avoid the UK Air Passenger Duty by starting your itinerary outside the UK even if you connect through the UK. For example, if you book an award flight from Paris to London and onwards to Chicago, you will not incur the UK APD if your connection in London is under 24 hours. But if you just book a flight from London to Chicago, then that booking will incur the UK Air Passenger Duty, because that itinerary originates in the UK.

UK Air Passenger Duty vs Carrier-Imposed Surcharges

Taxes are not the only cash portion of an award ticket. Carrier-imposed surcharges (also known as fuel surcharges) are another big component. This varies depending on the airline you're booking with and the airline you're flying. Not every airline imposes surcharges on awards, and not every loyalty program passes those onto customers.

For example, Air Canada Aeroplan does not pass on fuel surcharges to Aeroplan members booking awards, regardless of which airline you would be flying. Lufthansa imposes very high surcharges on awards, but if you redeem Air Canada Aeroplan points for a flight with Lufthansa, Air Canada absorbs Lufthansa's surcharges and does not pass them onto you. So you just have to pay taxes and other fees, but not the high carrier-imposed surcharges.

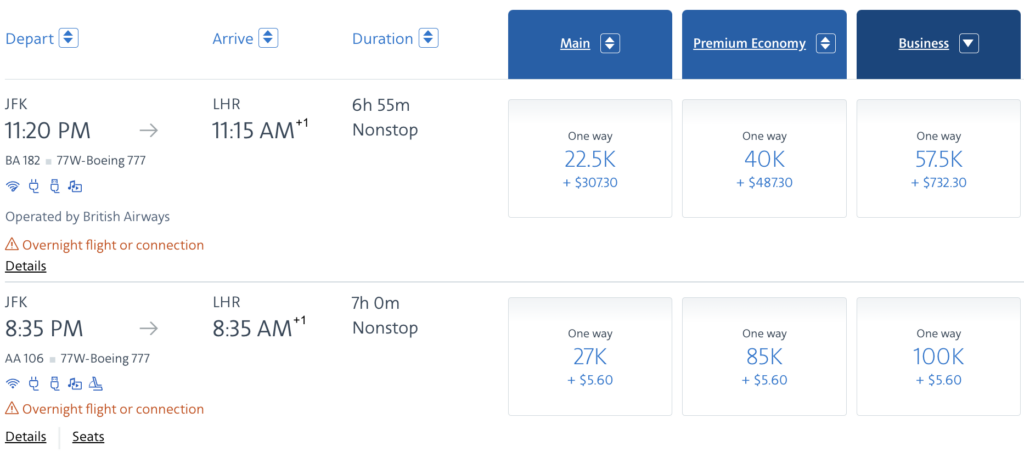

So if you see an award flight into the United Kingdom with a high cash cost, that means the airline you are searching with is passing on fuel surcharges. The UK Air Passenger Duty has nothing to do with that cash price because the flight is not originating in the UK. For example, let's compare two flights from New York (JFK) to London Heathrow (LHR), both available via American Airlines' AAdvantage program:

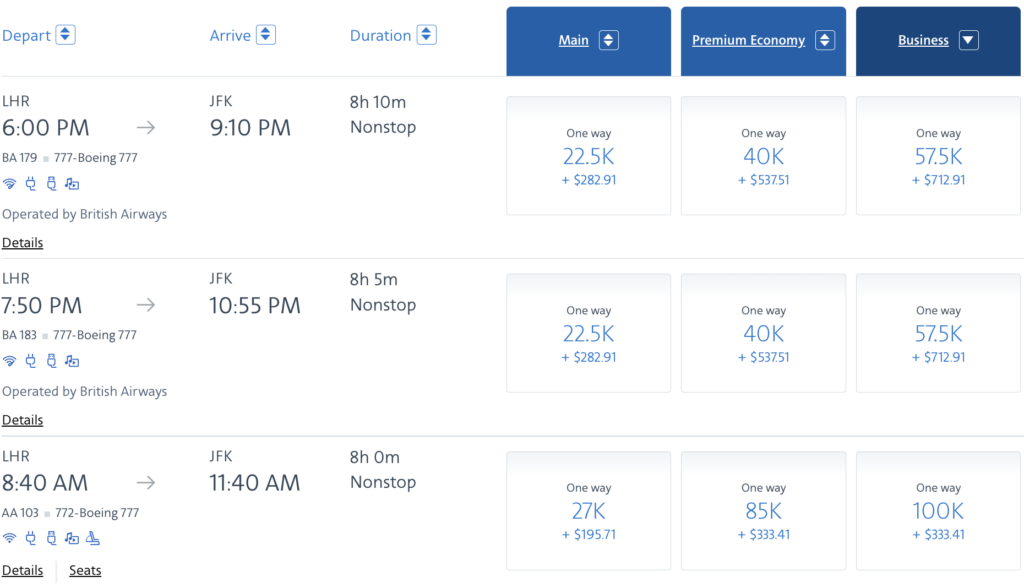

To hammer home the point, let's compare taxes and surcharges on flights from London to New York instead. Notice how even the American-operated flight in the third row now has a cash price of more than $300 in business class. That is the due to the UK Air Passenger Duty. Meanwhile, the cash portion for the British Airways-operated flight includes the UK APD and additional surcharges that BA passes on to its partners and American is passing on to the customer here. (Yes, fuel surcharges are actually higher departing the US than from the UK).

UK Award Taxes: ToP Thoughts

The UK Air Passenger Duty is a tax that applies to passengers on flights departing the UK. The APD applies to any flight originating in the UK, regardless of airline. Unfortunately for award travelers, the tax also applies to award bookings.