The short answer: You can't! It will cost you the taxes of your award flight, which is typically $5.60 or more. Otherwise, yes, you (yes, even YOU!) can travel around the world for free!!!

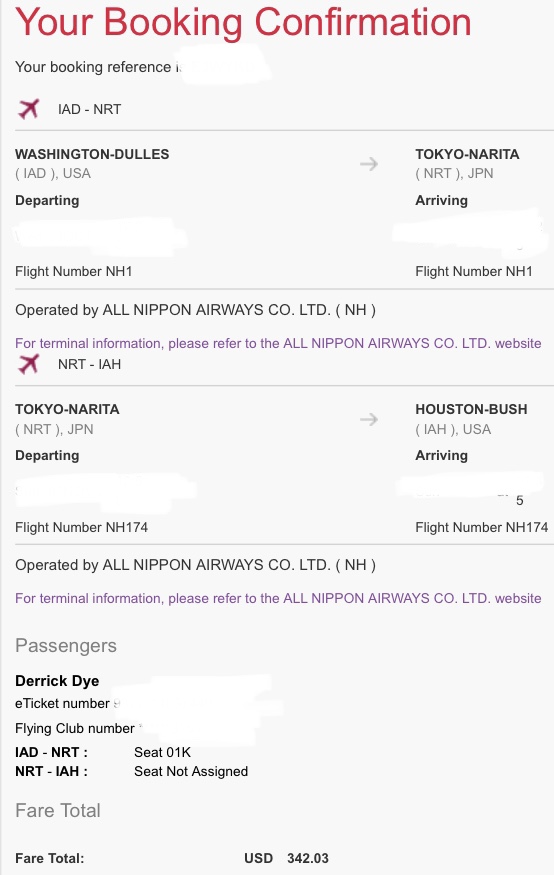

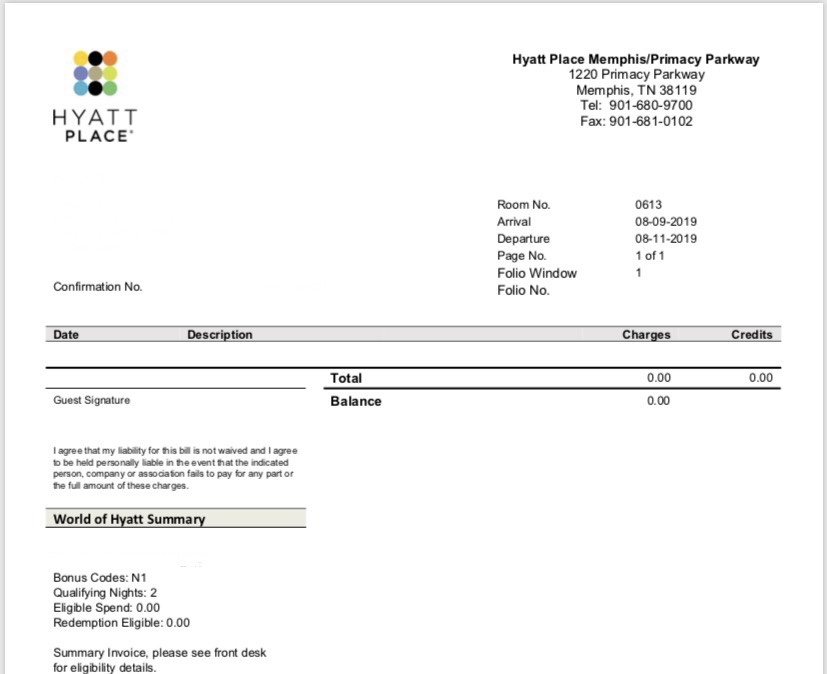

Before diving in to how to get this done, here are some examples of “free travel” to show the possibilities:

So with the disclaimer that you can travel the world for “free” might mean you spend a few hundred dollars per trip on taxes and fees, annual fees on your various credit cards, etc., I will explain how to begin your journey.

Like most things in life, there is an easy way and a hard way to earn points and miles. The hard way is “butt-in-seat” or “butt-in-bed” mileage earning. This is very difficult. For example, we flew a round-trip from Dulles (IAD) to Paris De Gaulle (CDG) in February. Our economy tickets on the 16ish-hour total round-trip flights earned us less than 2,000 United points each. Unless you're regularly flying business class and/or staying in hotels, it is very difficult to accrue significant amounts of loyalty points and miles.

So what is the easy way to earn points & miles? Credit Cards. Specifically, credit card sign-up bonuses. Rather than flying a round-trip from Washington, D.C. to Paris for 2,000 United miles, anyone can sign up for the Chase United Mileage Plus Credit Card and earn 50,000+ miles. If you have a business, the Chase United Business card currently has a 150,000-mile sign-up bonus. While I don't recommend rushing out and getting either or both of these cards as a beginner, it is an easy example of the vast difference between the “easy” and the “hard” ways to accrue points & miles.

I know, I know. Credit cards. Really? Yes, really! This is not a trick or a gimmick. It's a way for responsible people to maximize on the generosity of large (and small) banks to lure in new customers for long-term relationships. Whether or not you decide to remain for the long-term does not affect your ability to obtain large signup bonuses!

Before we go any further, I must “bust” several of the most common myths about signing up for credit cards:

- By signing up for credit cards, you must pay interest and fees. WRONG. Other than annual fees on some cards, there is never a good reason to pay ANY fees or interest on ANY travel card. The interest on travel rewards cards are oftentimes 18%+. If you are carrying credit card debt, please consider paying it down and/or putting it on a 0% credit card before starting this game. Sarah and I have not paid a dime of credit card interest in the last 3 years, despite using our travel rewards credit cards for everything.

- Signing up for multiple credit cards will destroy your credit. WRONG. In fact, the opposite is usually true. While your score may drop a point or two when you sign up for a new card (and have a credit inquiry), as you add credit cards to your portfolio, your available credit increases and your total credit utilization (your balances as a percentage of total available credit) decreases. Both of these cause your score to go up. In fact, Sarah saw her highest-ever credit score a few weeks ago, despite signing up for 11 credit cards in the last 24 months and 23 in the last 36 months.

- I don't earn/spend enough to accrue enough miles to go anywhere. You're actually right on this one. Okay, I'm joking. WRONG, WRONG, WRONG!!! This game is for blue collar workers and millionaires. You can use points to upgrade your vacation from a road trip in an old jalopy to a Greyhound bus or to go from flying paid business class to flying around the world in private jets. It's all possible. I know people who have done/are doing both! Also, you probably don't know how cheap it can be to go somewhere. Sarah and I flew to Houston recently for 3,100 miles each way per person. I am flying to Chicago in October for only 4,000 points. You can earn enough points from one signup bonus to fly 20 such flights (or more).

- Annual fees on credit cards aren't worth it. Oh really? Can I convince you otherwise? For some cards, this may be true. For others, the AF is worth it and more. We'll dive into this subject very soon, but a quick teaser is that we have a $450 AF card where the bank actually PAYS money to the cardholder, rather than the other way around. When used correctly, the cardholder can earn well over $700 per year in benefits, not including any points earned or a signup bonus. How does $250+ plus in FREE benefits sound?

So with this information in mind, Sarah and I will dive deeper into the beginner's basics for beginning your credit card rewards journey. Let us know your thoughts in comments or in our Facebook group.