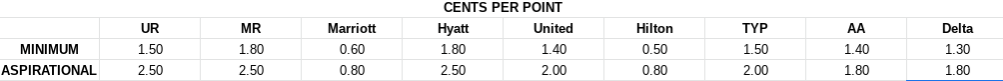

In yesterday's post, I explored the value of various points and miles. While it is a personal decision and calculation, it takes times of earning and burning to come up with your own valuations. For the beginners, I offered these “minimum” and “aspirational” values:

Table of Contents

Toggle

For beginners, any redemption at or above the “minimum” value is awesome. If you hit the “aspirational” values, consider yourself a veteran and an expert (at least at burning!). However, as I cautioned yesterday, there is a negative side to points and miles valuations.

The Negative World of Points & Miles Valuations

The banks, hotels, and airlines all know the internal valuations of their own currencies. Clearly, each program knows what a point or mile equals and what it can and cannot do. Unfortunately, the banks and other loyal programs exploit this. How so? Just look at the “big” sign-up bonuses: Hilton, Marriott, oftentimes Delta, etc., and you quickly realize that these companies are the same ones with the LOWEST points and miles valuation. Also, if a company repeatedly mentions how “easy” it is to use their miles, with “no blackout dates” or “seat restrictions,” you realize there is a catch. These companies do NOT want you to redeem your points for maximum value. Instead, they hope for several things: 1) that you sign-up for “newbie traps,” discussed more below, 2) that you redeem your points for the lowest value possible (including cashing out for gift cards, statement credit, etc.), and 3) that you sign-up for one or two of their cards and use them for everything. I won't even discuss how the banks hope you pay 20% or higher interest each month, because that's a whole different discussion. With this background in mind, let's discuss the biggest “newbie traps.”

Trap #1: Hilton Credit Cards

Hilton and its sole credit card partner American Express have several incredible products, including the Aspire and the Surpass. There are also the Hilton Business Card and the below-average Hilton Honors Card. You see staggering sign-up bonuses of up to 150,000. To a beginner, 100,000 to 150,000 points always seems better than 50,000 on the CSR. But wait, would you rather have 150,000 Japanese Yen or 50,000 USD? The answer is USD, of course (150,000 Yen is currently less than 1,400 USD). The same is true of Hilton points. While 150,000 points seems amazing, let me tell you that you will struggle to find 0.5 cents per point redemption values consistently. That means that if you strategically use your Aspire bonus, you will do extremely well to create $750 in value on a $450 AF card. These bonuses go all the way down to 75,000 ($375 at 0.5cpp). While the sign-up numbers are eye-popping, it's nothing more than polished pyrite. These bonuses just aren't that lucrative.

Trap #2: Marriott Cards

Marriott is one of the few programs that has multiple banks issue its co-branded cards. There is the Chase Bonvoy card, which currently offers 3 free nights, each up to 35,000 points each, for a total possible sign-up bonus of 105,000 points. Again, the numbers look awesome, 105,000 points for one sign-up bonus!!! Yeah, not so much. A year or so ago, before the Bonvoy program, there was real value in Marriott. Those days are long gone. As of September 14, and the introduction of the peak pricing award chart, you can use these night certificates if you are flexible and willing to spend time searching for what you want. For example, for Wednesday through Saturday of Thanksgiving, there are over 20 hotels in Manhattan where the 35,000 certificates should work. Unfortunately, only ONE of these hotels will work, after the peak pricing changes. If that hotel doesn't work for you, your next best option is down near Newark Airport! Suddenly, that 100,000+ sign-up bonus doesn't look so good. There's a reason this card is DEAD LAST in our list of the 18 best Chase cards! Don't fall for this “newbie trap.”

The same can be said for the Amex Marriott cards: Marriott Bonvoy Business® card and the Bonvoy Brilliant® card. Each of these cards holds value, through the annual certificate and other benefits, but both are not for beginners and not until loooong past 5/24.

Trap #3: Delta Credit Cards

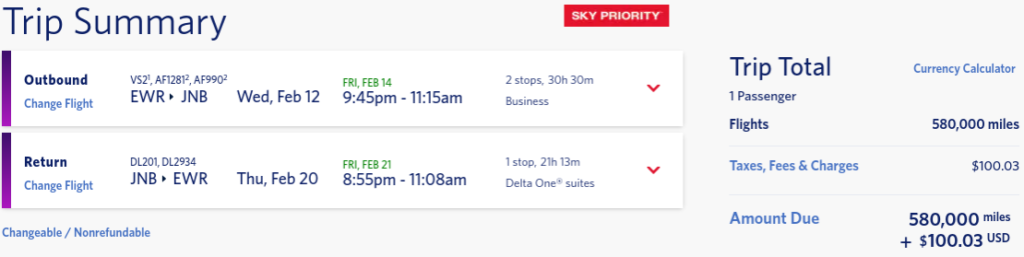

While Delta has impressed lately with almost weekly award fare sales to various places, the day-to-day value remains lacking. The Delta cards usually run bonuses between 40,000 and 80,000, which are almost always the highest for an airline credit card. But don't be fooled by this newbie trap. Delta knows that most beginners are not running award searches regularly and familiar with how much their premium awards cost. For example, here is the FIRST search I attempted to demonstrate how ridiculous (laughable?!) Delta's premium award fares can be:

While I will admit that Business Saver Awards to South Africa are hard to find, seriously?! 580,000 points for ONE ticket?! If you could sign-up for 9 or 10 Delta cards (spoiler alert: you can't), this is okay. Otherwise, HARD PASS! So before you give up a valuable 5/24 spot for that “really large” Delta sign-up bonus, remember that Delta has value, but mostly for advanced award travelers and/or those faaaaaaaaaaaar beyond 5/24.

Trap #4: Capital One Venture

I have a love/hate relationship with Capital One Venture (and the Barclays Arrival+ before it went away). While the Venture was my first travel rewards card, let me “erase” a LOT of money of my flying lessons (my flight school coded as travel!), and I have now received 2 sign-up bonuses on this card, I really just don't like it. Not so much because it lacks value, as there is a lot of value in this card, but more so because of the marketing campaign to draw in the masses because they don't know any better, akin to bugs to a bug zapper in the dark of night. Two miles for every dollar with no blackout dates is amazing! Except it's not. It's essentially a 2% cashback card that is restricted to redeeming your cashback only on travel charges (although Capital One has recently added transfer partners, this card still isn't very valuable for reasons we'll discuss in another post). Compare that to the values assigned above: 3x on CSR at dinner and then transferred to Hyatt for 4.0cpp equals a return of 12% per dollar. 4x on Amex Gold at grocery stores transferred to Virgin Atlantic for a First Class flight to Japan for 11 cpp equals a return of 44%. Do you see why “2 points per dollar” is a gimmick? Capital One assumes you don't know the value of their points and that you don't take the time to research what other options are available. Don't fall for this “newbie trap.” Yes, every traveling family should eventually have a Capital One card, but not until you are (dare I say it?) more than 10-15/24. There are just too many other cards to consider before this one. Don't fall for a very expensive marketing campaign. Do your research and then reap the (better) rewards!

Trap #5: Only Using One Card

You grabbed a CSP or CSR. Great! You made it through the first four “newbie traps” unscathed. But please don't relax and think the journey is over. The credit card companies want you to grow comfortable paying all your bills, putting everyday spend, etc. on one card and then forgetting about doing anything else. Don't fall for this “newbie trap!” Trust me, this is more than a sales pitch for you to sign-up for credit cards. If you don't want more credit cards, that's fine by us. It is not our loss. Pointing out this trap is to educate you on the power of accumulating points quickly with a carefully planned portfolio of travel rewards credit cards. An easy example is my recent post regarding the Chase Trifecta. With only three credit cards, you can earn URs (which I value between 1.5 and 2.5 cpp) at 2x or 3x on restaurants and travel, 5x on up to $1,500 in spend each quarter, and 1.5x on ALL other spend. Don't grow complacent and settle for one sign-up bonus. Strategize to maximize!

Conclusion

Don't fall for any of these “newbie traps.” It's as simple as that. Also, TOP is not trying to set you up for Trap #6. Each card listed above includes TOP's link. WE DO NOT WANT YOU TO USE ANY OF THEM IF YOU ARE UNDER 5/24. The links are there only for those over 5/24 and we are not trying to trick you. Fair enough?

As always, please leave your comments below or join our Facebook Group to give us your comments, feedback and questions.