Travel on Point(s) has partnered with CardRatings for our coverage of credit card products. Travel on Point(s) and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Table of Contents

ToggleThe points and miles hobby has a big emphasis on the points you can earn from signing up for new credit cards. This is emphasis is deserved because of the value that can be found in points as well as because of the large bonuses earned for a relatively small amount of money spent. But even without a credit card, there are still plenty of other ways you can earn money or points.

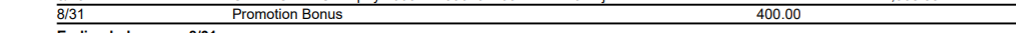

Bank Bonuses

One way to earn money is to signing up for new bank accounts that are offering bonuses. Most will earn you between $200-$600. In fact, Doctor of Credit has an entire section dedicated to bank account sign up bonuses. In order to earn the bonus you must open a bank account and and meet the offer's terms. These usually include making a deposit, making direct deposits, or having a certain amount in your account for a minimum amount of time. Many bonus offers are focused on direct deposits. This can be done easily if you can adjust your employer deposits. Often there are other creative ways to make deposits that will meet the direct deposit requirement, such as using a prepaid card to transfer money into the account. These creative ways can vary by bank.

Once you have earned the bonus, you need to decide whether you want to close the account or keep it. Usually, to keep an account fee free, you will need to be sure that certain requirements are met. For example, with US Bank, I simply need to make a direct deposit to my account to keep it active. My Wells Fargo account has the same requirement, therefore I have kept both open. In addition, I may want to pursue a credit card with either or both of those banks, so I feel it is best not to close accounts before that happens.

Shopping Portals

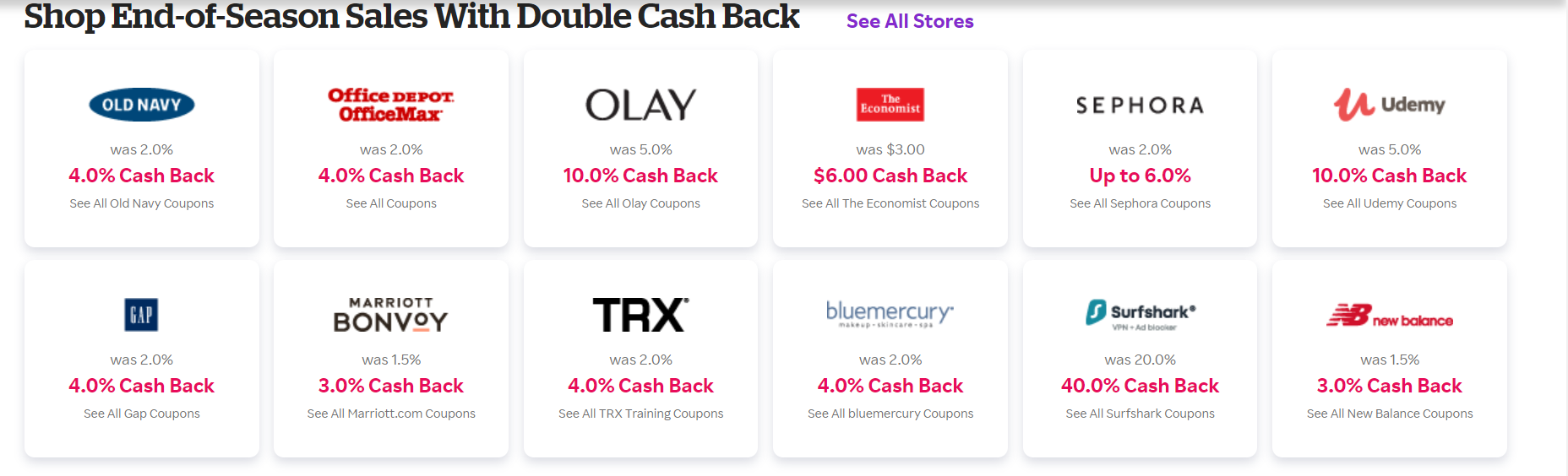

Who has time to shop when you're busy traveling the world? If you're like us, most of your shopping happens online. Many rewards programs have a shopping portal that will allow you to shop through their site and earn extra rewards points for purchases, no specific credit card necessary. The #1 tool for shopping portals is Cashback Monitor. It will tell you what each portal offers for a particular site you're using, so you can decide which one to use to maximize your earnings.

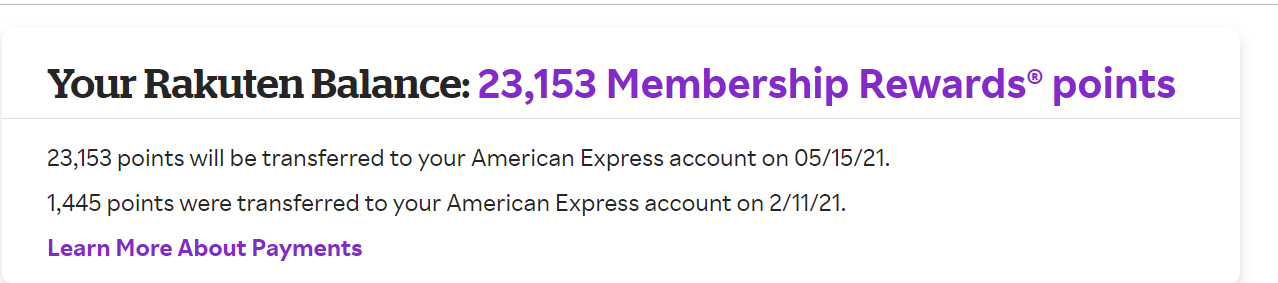

There are cash back only portals, like Rakuten (formerly Ebates) that will pay you (once a quarter via check) for your purchases. Just sign up for an account, and before your next online shopping purchase, go to the Rakuten website first. They frequently run promotions with up to 15 cents back per dollar spent. If you have an American Express card that earns Membership Rewards, you can sign up for a Rakuten account that will earn you Membership Rewards points instead of cash back, if you prefer! [Spoiler alert, we value Membership Rewards higher than 1 cent per point, so a Rakuten account that earns Membership Rewards could be more valuable].

Chase has its own shopping portal that you can use if you have any of their Ultimate Rewards earning cards to help you accumulate those points faster. There are also portals for the major airline loyalty programs, if you're trying to accumulate those miles with a specific redemption in mind.

Rebate Apps

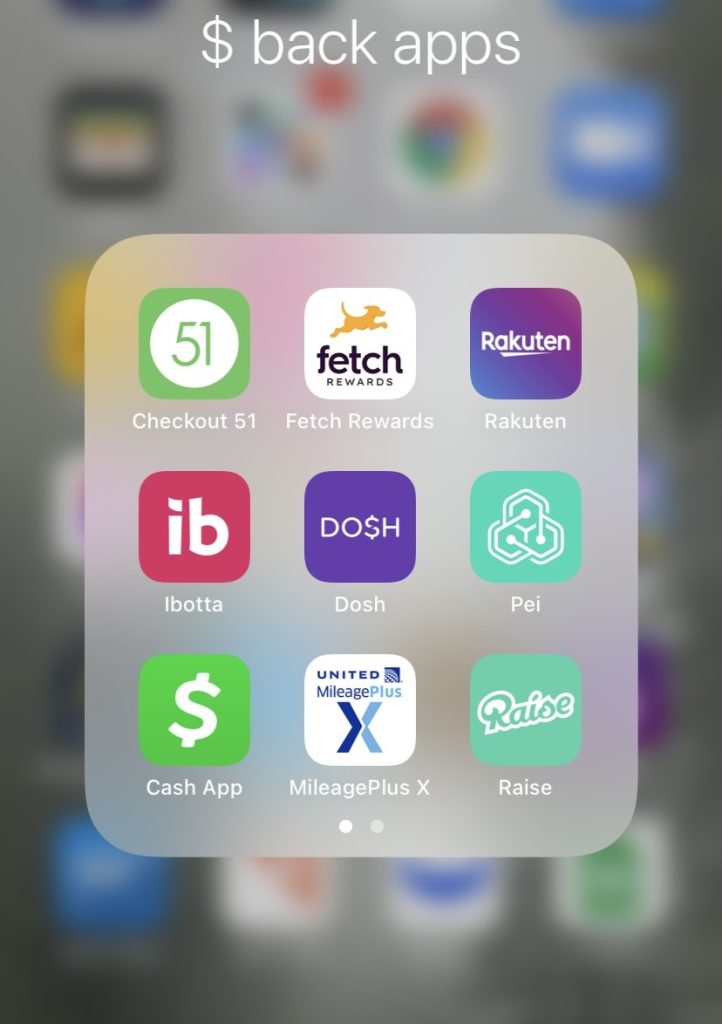

Another way to save is through rebate apps on your phone or computer. Each of these work somewhat differently, but give you cash back for your purchases.

Receipt Apps

Ibotta: While widely considered a grocery shopping, app, Ibotta actually has many retailers available and even its own shopping portal. You simply add offers to your account and get cash back when you redeem them. Our full review is available here.

Upside: claim offers in the app (note the limited time you have to redeem), complete your purchase, and upload a picture of your receipt to earn cash back through the app. Upside seems to only be available in the Eastern U.S., but it can stack with Fuel Rewards to earn you even more cash back on your purchases at Shell.

Fetch: Fetch is a receipt scanning app which only requires a picture of your receipt – no scanning of UPC codes or anything additional. At a minimum you will earn 25 points for each receipt. Purchase special items at the store and earn up to thousands of points. You can then redeem these points for for gift cards at various retailers at a typical rate of 1000 points:$1. You can read our full review here.

Portal/Credit Card Linked

Do$h: Download the app, link your credit cards and earn cash back for in-store and online purchases. The app tells you which offers are available, but you don't have to choose or add them in advance. Read our full review here.

Payce: Similar to Dosh, this app has offers which can be activated monthly. You link a credit card(s) to the app to earn cash back. Read our full review here.

Pei: The Pei app uses your linked credit cards to track your spending. If you make a purchase at a qualifying establishment, it earns you points. These can be cashed out. See our full review here.

Other Apps

Groupon: Groupon is available online or on the app. You can also link to a chase earning card to earn Groupon bucks. Read our full review here.

Mileage Plus X (MPX app): This is the United app for earning extra miles for simply making a purchase (technically of a gift card) via the app. This can work in a couple ways. One example, is Starbucks. You can buy a gift card and then turn around and load it to your app. Secondly, you can pay for a purchase in line at a store or online by simply entering the amount, which automatically purchases a gift card in that amount, which then you enter or scan right at the register.

Stacking

Stacking is when you combine one or more offers to earn more points or save more money. As just one example of this, here is a recent one I completed.

I ordered meal delivery kits from Green Chef. When I signed up for the service, I went through the Rakuten app which earned me cash back and a discount on my first three orders. In addition to this, several of my Chase cards had an offer for 20% off. So, I saved via Rakuten and then used Chase offer to save an additional $6.59 making my first week only $25 for three meals with two portions each.

I can also buy gift cards at a grocery store, which now puts me in grocery category where I have cards that earn more. I earn 4x with my American Express Gold card or sometimes Chase cards have a grocery elevated earning as well. Next, I go through Rakuten portal to earn points or cash back on my purchase and pay with the gift cards I purchased at the grocery store. Many times, even when using a gift card the portal will track the full amount. For example making a $100 purchase with a $50 gift card the portal will still credit you as a $100 purchase. As we like to say, your mileage may vary (YMMV). Either way, I come out ahead points-wise.

There is no right way or wrong way to do this. Extra savings and points earnings is what it is all about.

I do not fly United very often, but when I need a Starbucks gift card quickly and do not have time to stop anywhere, I use the United MPX app. The great thing about the MPX app is you can use your highest-earning Chase dining card. For example using the Chase Sapphire Reserve will earn you 3x on this purchase. If you have your credit card linked to the Pei app, you would also earn those points. Finally, if you had a Chase offer (found in your account or Chase app) for Starbucks, these may trigger that discount as well. Again, I may not fly United often, but why not add on United miles to a stack?

Gas Saving Programs

Many gas stations and grocery stores have points programs that allow you to earn credits towards your fuel purchases. One of my favorites is Fuel Rewards, which are redeemable at Shell stations around the country. You can earn savings directly through Fuel Rewards, or you can link other rewards programs to redeem your points through Fuel Rewards on gas at Shell. We have linked our Giant card to Fuel Rewards and have seen the savings pile up.

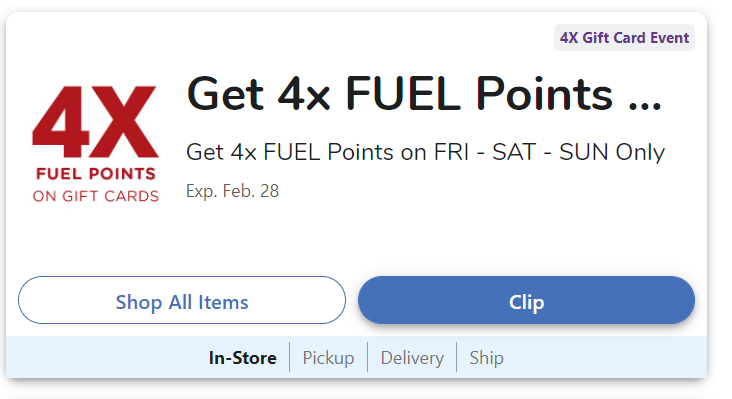

Grocery store gas points programs can also be a source of great savings on their own. Many have bonus gas points promotions, including on buying gift cards (which you can then use to cover other ordinary expenses). Check the weekly circular (available on the store's website) and/or the mobile app to add digital coupons.

Final Thoughts

You might be reading lots of information on points, miles, and sign up bonuses. They fill up the blogs and Facebook pages on a daily basis. However, overlooking some of the methods we have mentioned above, could be losing free money. That free money could be to the tune of hundreds of dollars a year, if not more. All for simply doing one or two bank accounts per year or scanning some receipts for a few seconds after each shopping trip. Making one extra click before online shopping can be the most valuable of them all. Just like investing, I like to diversify, and this is no different.

Try out some of these great apps or methods and pick some that work for you. Are you earning cash back via apps? Want to find out more? Come over to our Facebook group and let us know your thoughts.