Annual Travel Insurance Plans

Like most travelers, we rely on insurance to protect us if anything goes wrong during our travels. Coming out of COVID, we decided to purchase an annual travel insurance plan to supplement / replace the insurance on our travel rewards credit cards. Sure enough, we had several issues and it came in handy, but what a frustrating experience all around. Will we renew? Are we switching companies? Are we satisfied with the service we received? We break it all down here.

Table of Contents

ToggleWhat are Annual Travel Insurance Plans?

Like the name suggests, annual travel insurance plans are insurance policies that you purchase for yourself or your family. These policies cover all travel during the policy period, typically one year. You can raise and lower your coverage amounts, include or exclude services, etc. At it's core, it is another insurance policy to protect you from financial harm.

Some of the favorites for annual travel insurance plans are squaremouth.com, insuremytrip.com, and Allianz. After doing our research, we landed on Allianz.

Our Experience With Allianz

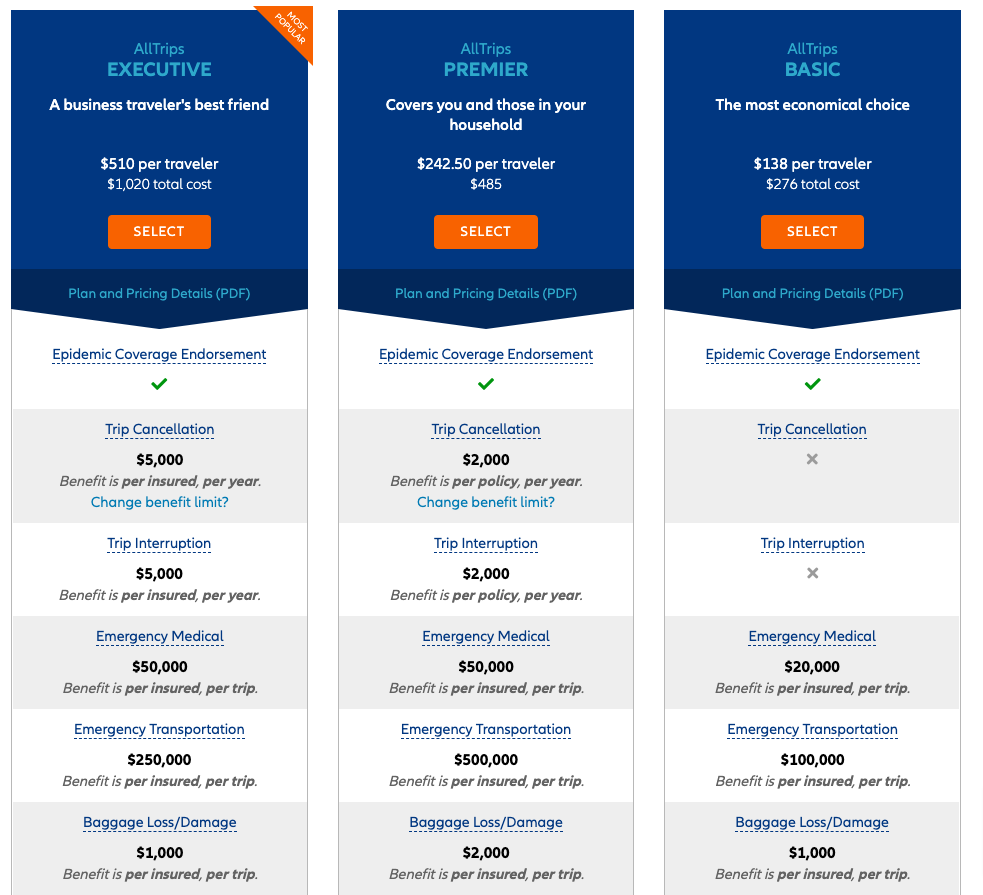

Allianz is the favorite annual travel insurance company in the award travel circles. It offers three levels of annual coverage: Executive, Premier, and Basic. We selected the mid-tier plan, AllTrips Premier, and our annual policy premium was $485 for 2 travelers.

We did not modify the coverage amounts in any way and left the policy with the limits seen above. For reasons I explain below, this was not sufficient.

The Good, The Bad & The Ugly in Year One

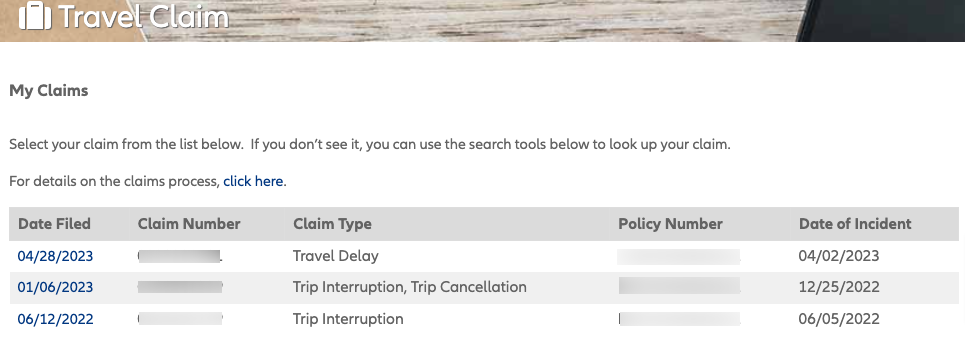

The good news for year one of this annual travel insurance plan is that we traveled a lot! The bad news is that lots of things happened and we filed three claims. The ugly news is the amount of time, effort and frustration it took to file and resolve these claims. I break down each of them below. One ended favorably, albeit frustratingly so, one ended only partially favorable, and one remains pending.

Annual Travel Insurance Claim #1

While traveling in Europe in summer 2022, I tested positive for Covid. We had to cancel our flights and await a negative test before flying back to the USA. Once we returned home, we filed our first claim. This included flight & hotel cancellations and re-bookings, meals, transportation costs, and Covid tests. I filed the claim on June 12, 2022.

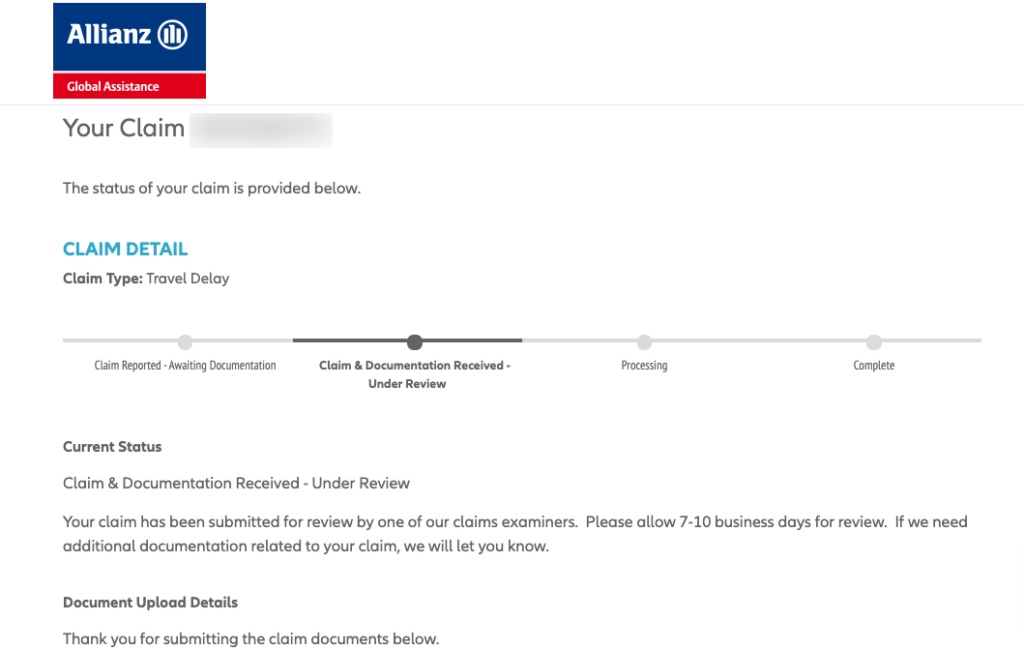

Allianz did not review the documents submitted for almost 60 days, despite assurances that documents were review in 7-10 days. In total, I resubmitted documents on 3 occasions. Each time, the result was a delay of another 14-28 days. Finally, in mid-October, we received reimbursement of 100% of our costs. This included a cancelled Fine Hotels & Resorts stay, taxes and fees on new award flights home, hotel and meal costs while stuck in Europe, transportation to and from all airports, and costs for Covid tests and reporting. Despite the frustrating delays, we are pleased with this outcome.

Travel Insurance Claim #2

During the week between Christmas 2022 and New Years' Eve (anyone remember the massive Southwest nationwide meltdown?), our flight from Washington, D.C. to San Francisco was cancelled 18 hours before our flight. We had a 4 night stay at Ventana Big Sur and 3 nights booked with Hilton Free Night Certificates, so we did not want to postpone our trip. Once we had confirmation from Alaska Airlines that it could not rebook us for 4 days, we took matters into our own hands. We found the cheapest economy flights from Washington, D.C. and the Bay Area for the following day and paid cash. As you can expect, with a nationwide travel meltdown and the holidays happening, flight prices were insane. Our economy seats on United were over $1,900 for the two of us.

Issues Filing The Claim

Approximately a week after we returned home, I filed the claim. Based on a telephone call I had with Allianz, I filed a trip cancellation claim. The policy indicates Trip Cancellation coverage includes the cost for comparable airfare to replace your cancelled flight. Within a week, we received a direct deposit for the amount of our Alaska flights, not the United flights that were almost quadruple the cost. I followed-up with Allianz. After hours on the phone pleading our case, and eventually requesting a supervisor to assist, we confirmed alternative airfare IS allowed, but is part of a trip interruption claim.

Refiling The Claim

So the agent refiled the claim on our behalf and I manually uploaded all documents a second time. Within a month, we received another direct deposit. It was a partial payment of approximately $1,200. Combining the refund from Alaska and the payment from Allianz left us around $300 short of the total cost of the replacement flights. The one line explanation said that we had “exceeded coverage.” I had neither the time nor the energy to keep fighting, so I let it go. Recouping $1,600 of our $1,900ish costs was good enough.

Overall, we never received an explanation for not receiving full reimbursement We followed the policy to a “T” and kept the claim under the $2,000 threshold.

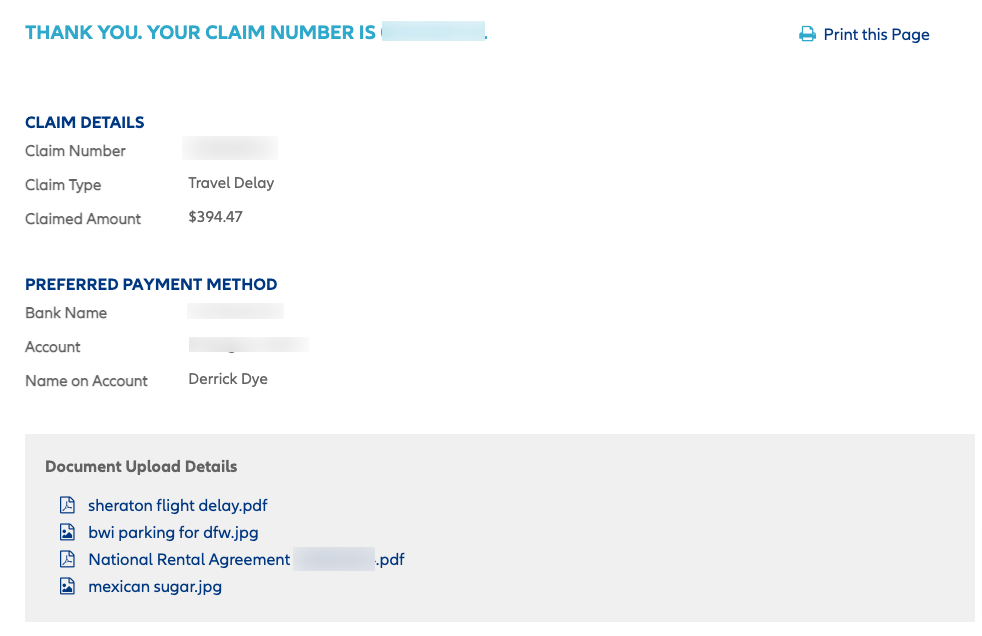

Annual Travel Insurance Claim #3

During the final presentations at the ToP Dallas Meetup in early April, many of the attendees' flights were cancelled for that evening. Sarah & I were victims of the cancellations and did not have ample opportunity to rebook ourselves that evening. So we stayed at the Dallas Meetup hotel another night. I recently filed a claim and requested reimbursement for 2 meals, the rental car, an extra day of parking at our home airport, and the one night hotel stay. This totaled just under $400. I will update this post when a final resolution occurs. As we kept our expenses to a minimum and submitted detailed receipts, I am hopeful for a quick resolution and full reimbursement. As always, I requested payment via direct deposit, so we are not waiting for a check in the mail.

Annual Travel Insurance Plans: ToP Thoughts

Overall, we are pleased with our Allianz annual travel insurance plan. Yes, there have been some headaches along the way. One headache I discovered just today is that you cannot submit a document that has punctuation in the name, in my case an apostrophe. It took 15+ minutes to figure that out. Also, if you resubmit a SINGLE document, or upload a document for the first time, your claim leaves the queue and the 7-10 business day clock start anew. As mentioned previously, the 7-10 business day quote for document review seems overly generous. Two of our 3 claims took MUCH longer than 7-10 business days for each document review.

Despite all the criticisms, we plan to renew our annual travel insurance plan with Allianz. We plan to increase the policy coverage, as we quickly learned during the Christmas/New Years 2022 claim that $2,000 is nothing in the grand scheme of things. It barely covered replacement airfare, much less anything else. We will bump trip cancellation and interruption coverage to $5,000 for next year.

Do you have an annual travel insurance plan? What company do you use? Come over to our Facebook group and let's discuss!