Travel on Point(s) has partnered with CardRatings for our coverage of credit card products. Travel on Point(s) and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

With worldwide travel brought to a screeching halt by COVID-19, credit card companies continue to roll out limited-time benefits to entice their customers to use their cards, renew their cards, and pay annual fees. After all, when you aren't using travel benefits, rental car insurance, airport lounges, Priority Pass restaurants, etc., why are you paying $400, $500, or even $600 annual fees? Among the major banks, Chase has rolled out numerous incentives to keep its customers loyal. First, Chase announced almost all personal cards had limited-time category bonuses for grocery stores and supermarkets. Later, Chase announced a similar benefit on its Sapphire cards for streaming services and gas stations. Not to be overlooked, however, is the ongoing “Pay Yourself Back” promotion. This feature allows you to redeem your points like cash. Is this a good option for you? Let's take a look and run the numbers.

Table of Contents

ToggleHistory of Cash Back

Prior to the “Pay Yourself Back” promotion, Chase allowed its customers to redeem their Ultimate Rewards for cash back. Unfortunately, the redemption rate is only 1.0 cents per point.

Similarly, you can redeem your Ultimate Rewards for gift cards. The rate for gift cards is also 1.0 cents per point, unless a particular brand is on sale. If so, you can obtain 1.11 cents per point.

Most award travelers understand that neither of these options represents a good value. As we previously discussed, ToP values Chase Ultimate Rewards at 1.5-2.5 cents per point. Thus, most savvy award travelers never used their Ultimate Rewards for cash back or gift cards.

“Pay Yourself Back” Promotion

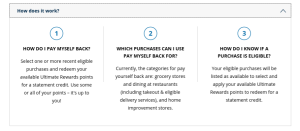

Beginning May 31, 2020, Chase allows all Chase Sapphire Reserve®or Chase Sapphire Preferred® Card cardholders the option to “pay yourself back” for any purchases made in the past 90 days at grocery stores, dining at restaurants (including takeout & food delivery services), and at home improvement stores.

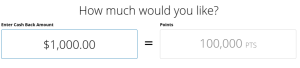

The best part of the “Pay Yourself Back” promotion is the redemption rate. Both Chase Sapphire Reserve and Preferred cardholders can redeem their points in this promotion at the same rate as in their Chase travel portal (i.e. 1.5 cents per point for the Reserve and 1.25 cents per point for the Preferred). This offers much more value than the historical use of Ultimate Rewards for cash back.

All eligible charges in the past 90 days appear in the “Pay Yourself Back” page of the Chase Ultimate Rewards Portal. From those eligible charges, you can decide which, if any, you want to redeem points to cover. The portal will show the required number of points to redeem a specific charge, again at 1.5 cents per point (CSR) or 1.25 cents per point (CSP).

Should I “Pay” Myself Back?

This is a very personal question. There is no right or wrong answer and everyone's situation is different. Rather than asking whether you should or should not pay yourself back, I recommend asking yourself these questions:

- Do I usually use my Ultimate Rewards in the Chase Travel Portal (CSP or CSR)?

- Do I usually transfer my Ultimate Rewards to Southwest Airlines (CSR only)?

- Do I transfer my Ultimate Rewards to Hyatt, United, or any other partner and usually get 1.7 cents per point or less (CSR only)?

- Do I need cash for day-to-day expenses or to offset income loss (CSP or CSR)?

If you answered “yes” to any of the above questions, you probably want to pay yourself back with your Ultimate Rewards.

For the Chase Sapphire Reserve, if you use your Ultimate Rewards in the travel portal, you will redeem at the same rate either way, so it is better to have cash now and use it later to book your travel. In the case of hotels, you'll earn points and elite credits for the stay, whereas you would not for a hotel stay booked through the travel portal. Likewise, Southwest Airlines redemptions are almost always 1.4-1.5 cents per point, so, again, it is better to have cash now and then earn points on the cash booking in the future. For transfer partners, if you earn 1.5 cents per point by paying yourself back and then use that cash to book your partner flights or hotel stays, you should earn at least 1.7% and probably much more. This calculation is a combination of the 1.5 cents per point you cashed out plus the points/miles you'll earn from the stay/flight (that you would not have earned on an award flight or stay). Lastly, if you are in need of cash due to the economic stresses of 2020, this is an easy way to have an influx of cash.

For the Chase Sapphire Preferred, the analysis is much the same. If you regularly use your points in the travel portal or you need cash for day-to-day expenses or to offset any income loss, it makes sense to “pay yourself back.” If you regularly transfer your CSP Ultimate Rewards to a UR partner, it does not make sense to cash-out your points.

Final Thoughts

Chase's new “Pay Yourself Back” promotion remains available for Chase Sapphire Reserve and Chase Sapphire Preferred cardholders for purchases in these categories until September 30, 2020. While it has been reported that this feature will continue beyond September 30, 2020, the eligible purchase categories will change on a quarterly basis. As a result, it is worth it to scrutinize your redemption activity and determine how you typically use your Ultimate Rewards. If you typically redeem your URs through the Chase Travel portal, it makes sense for you to “Pay Yourself Back.” Have you already done this or are you considering it? Come on over to our Facebook group and let us know.