Recently, Chase increased the sign-up bonus for the Chase Sapphire Preferred to 100,000 Ultimate Rewards after $4,000 in spend within 3 months ($95 annual fee). The 100,000 points is valued at a minimum of $1,250. With this latest increased offer, let's explore how you can you 100,000 Chase Ultimate Rewards (URs) to go on a trip. Today, we explore how to use 100,000 URs for a trip to Cancun, Mexico. Since the CSP requires $4,000 to spend to earn the bonus we are basing all trip totals on a budget of 105,000 URs.

Table of Contents

ToggleFlights

Southwest is a Chase transfer partner that flies to Mexico from many U.S. cities. This makes them a great option for flights to Mexico. You can read up on how to transfer points to Southwest here. While URs with the CSP can be redeemed at 1.25 cents each, transferring to Southwest will usually yield you 1.2-1.5 cents each in value. It always helps to compare cash value versus points. To show how accessible this trip can be from many parts of the country, we searched for flights out of Baltimore, Chicago, and Seattle.

As a reminder, be sure you keep an eye out for the Southwest change trick to open up. This is when Southwest allows free changes to existing reservations without having to pay for difference in fares, regardless of route or date. Typically, the change trick falls within a certain date range and is limited, and may disappear fast at times. Be sure to join our Facebook group to learn when the change trick opens and you can make the most of it.

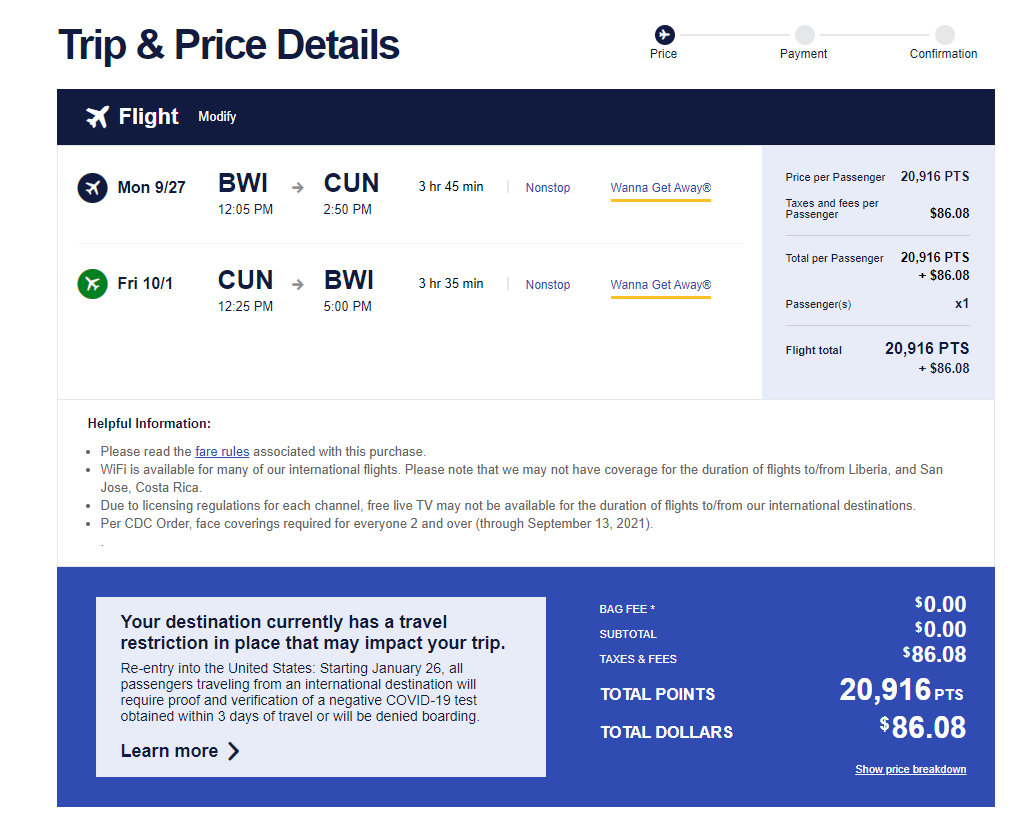

BWI-CUN 20,916 points round trip, both nonstops, and $86.08 in taxes

Total for two is 41,832 points and $172.16

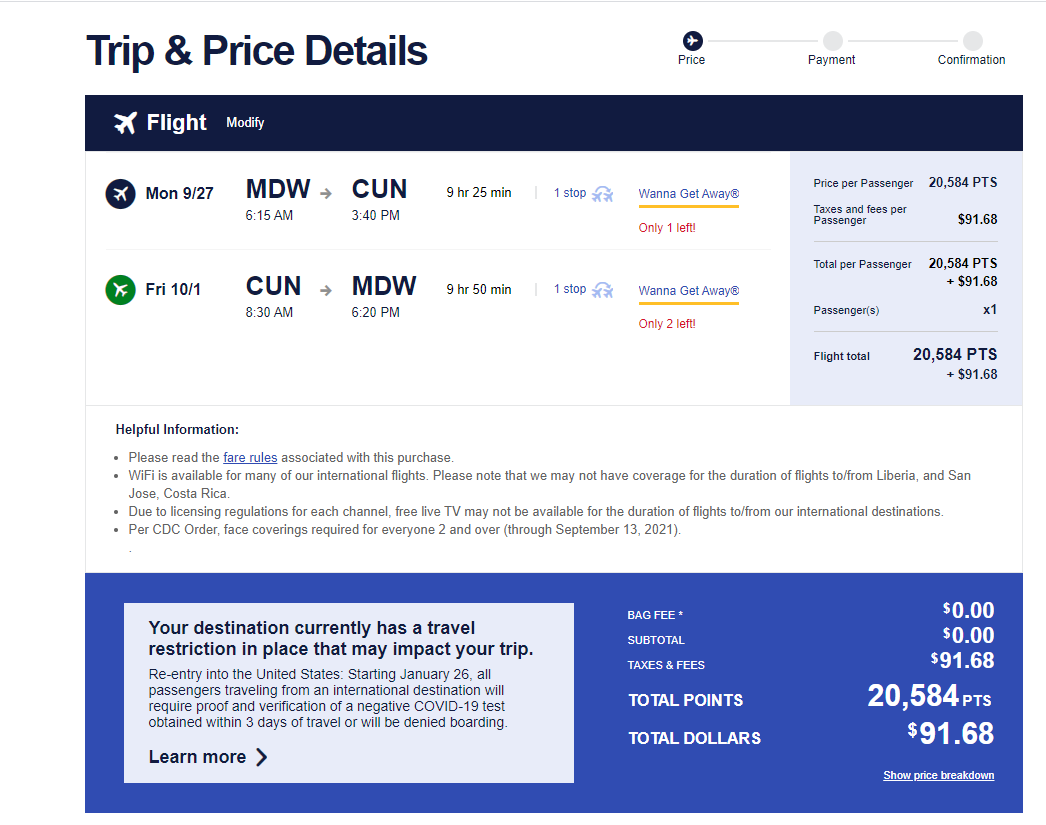

MDW-CUN 20,584 points round trip, each with one stop, and $91.68 in taxes

Total for two is 41,168 points and $183.36

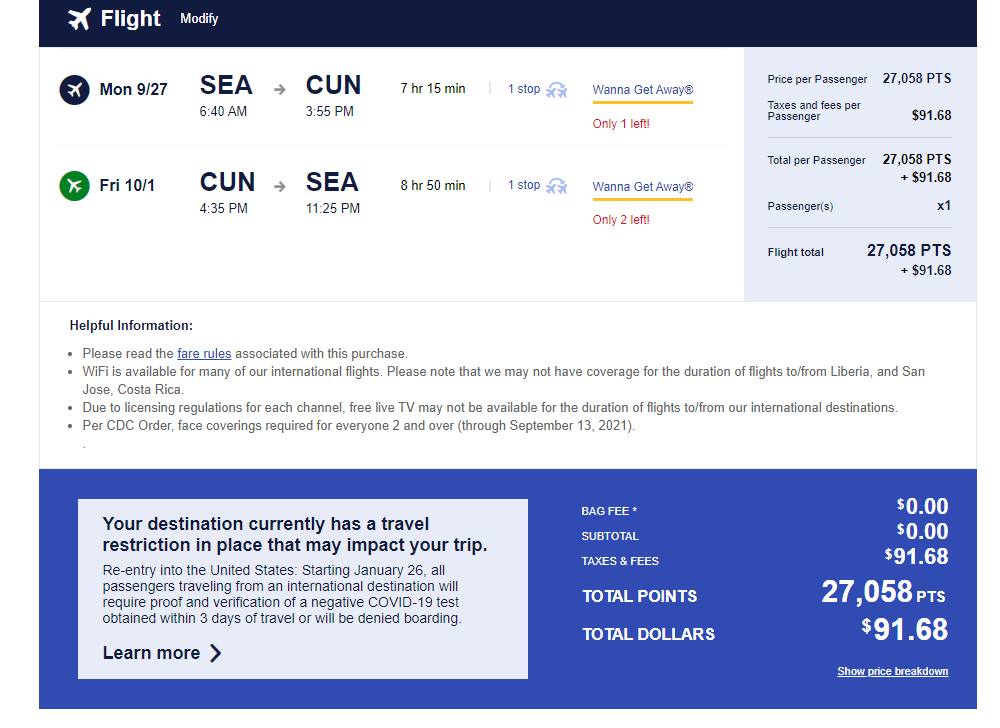

SEA-CUN 27,058 points round trip, each with one stop, and $91.68 in taxes

Total for two is 54,116 points and $183.36

Based on these sample searches, we would have about 63,000 URs left if flying out of Baltimore or Chicago, and about 51,000 URs left if flying out of Seattle (assuming we book flights for two people).

Remember: if flights are especially cheap for your dates, you can also use Chase Pay Yourself Back to cash out your URs at 1.25 cents per point with the CSP (1.5 cents per point with the CSR).

Hotels

With Mexico travel booming, many hotels are at peak pricing for award redemptions based on their categories. However, one method to help cover the costs of a hotel is using Chase Pay Yourself Back. While these are limited to certain categories such as home improvement, dining, and groceries, you can easily erase charges to help pay for your hotel stay. For example, you can erase your $750 in grocery and dining charges for points (60,000) and instead use that cash to book your trip. Below we explore three hotel options with the URs that are left from our budget of 105,000 URs:

Option 1: Westin Cancun and Spa

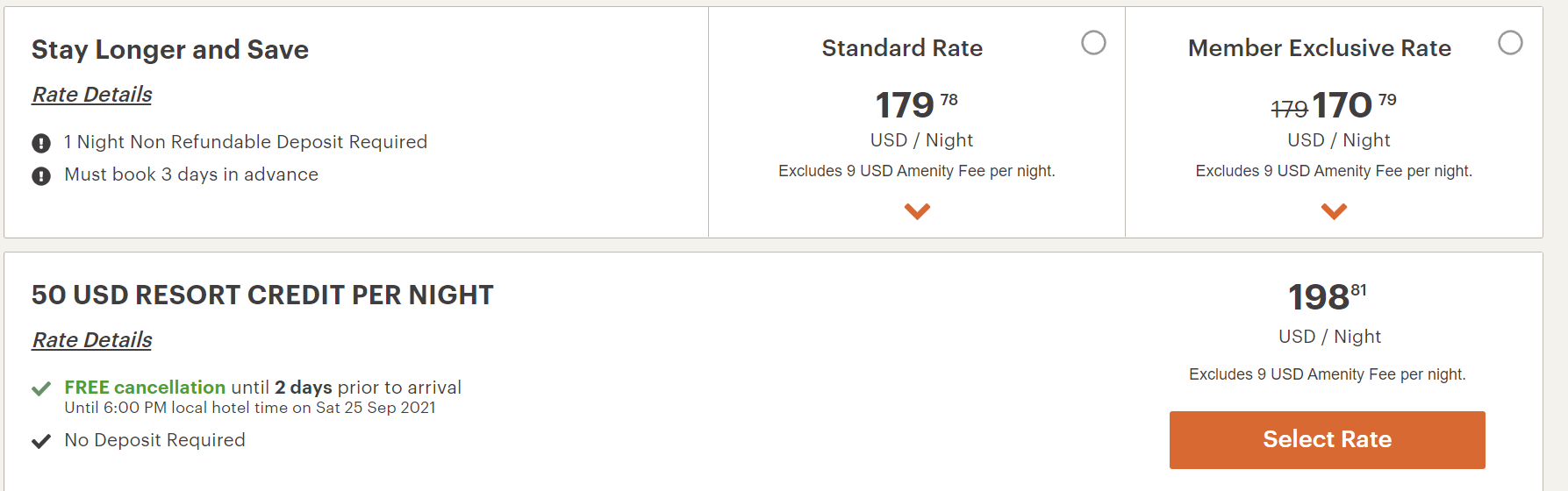

This hotel provides several options, which go as low as $586 for four nights on a AAA rate. However, they actually have a deal for four nights in a lagoon view room for $676 or an ocean view room for $771. Both those rates ($676 & $771) include a $50 resort credit per day.

As always , it is important to compare the hotels points rate in this case Marriott vs using pay yourself back and going with the cash rate. If using Marriott points this hotel cost you 110,000 total for four nights just for a basic room, meaning cash rate makes more sense.

Here is how many URs you would need to cash out via Pay Yourself Back for each rate.

- $586 (46,880)

- $676 (54,080)

- $771 (61,680)

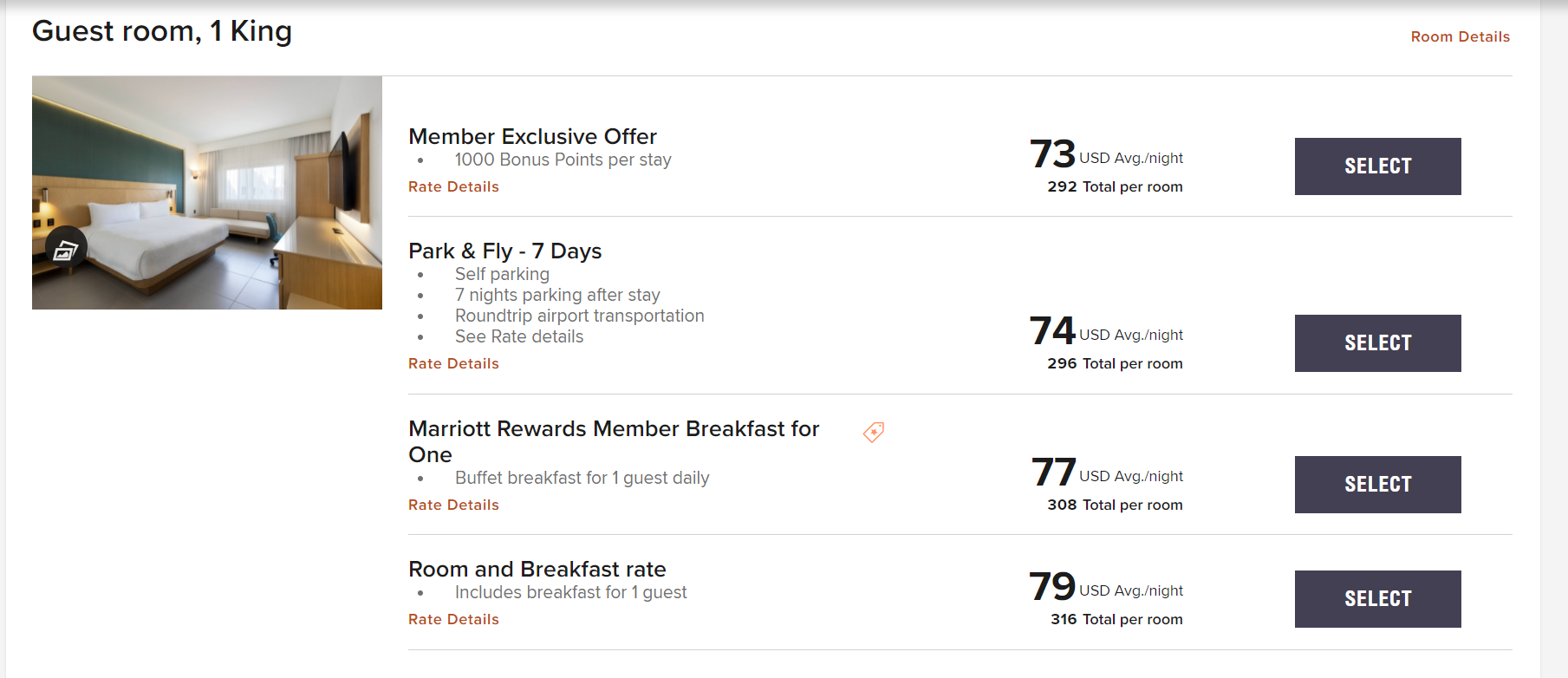

Option 2: The InterContinental Presidente Cancun Resort

This IHG property starts at just $128 per night. The four night stay comes in priced at just $652. With hotels, there are many different price options based on each individual's preferences and needs. It is important to look at all the fine print on cancelation polices as well.

We also found this interesting deal below that gives you club level (including lounge access) and a $50 resort credit per day, and a much nicer room. It also triggers a more favorable cancelation policy as well. So while you are paying just over $300 more, you earn $200 in resort credits plus the lounge access.

Here is the breakdown of URs requires to cover each of these Intercontinental rates via Chase Pay Yourself Back:

- $652 (52,160 points)

- $987 (78,960 points)

The latter would put you over the 105,000 URs mark but we wanted to show you the benefits that a more expensive room can include. You could use some cash out of pocket as well if you wanted to splurge on a nicer room for the added benefits.

The IHG website also shows you how many IHG points the room will earn you just for being a member. Plus, you can earn even more points on this stay by using an IHG credit card.

IHG is also a Chase transfer partner. So if prices for this Intercontinental hotel climb, transferring URs to IHG could be a better option. For these dates, this hotel was going for an average of 44,000 IHG points per night, which is too much based on cash rate.

Option 3

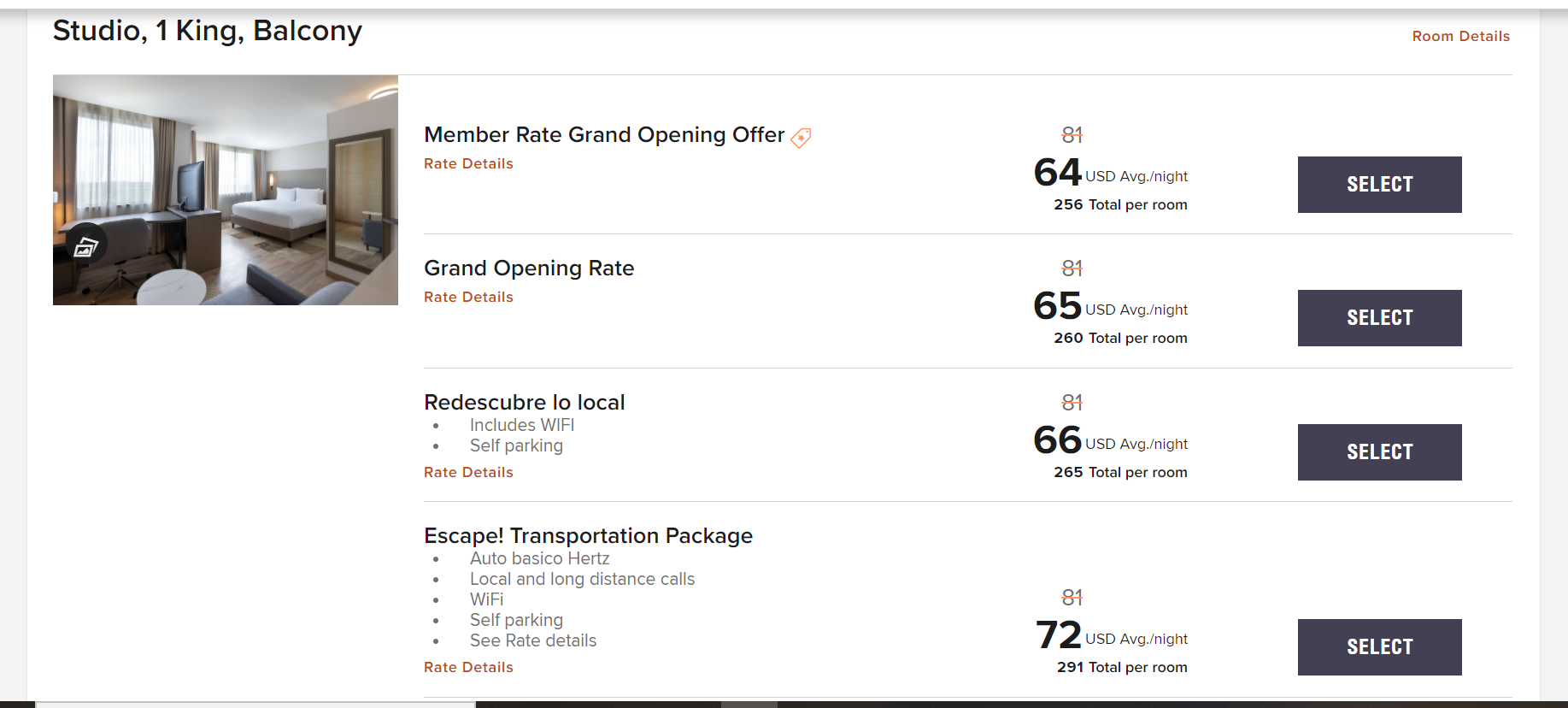

Another alternative is staying a little farther away from the beach and excitement at a much lower cost. Marriott offers options by the airport as well as one closer to the beach areas for under $75 cash per night. That is correct, cash is still king here on these rates as well. Why spend 60,000 or 80,000 for four nights when rates are as low as $64 per night.

The airport option is just as affordable. Although some of the pricing appears a bit confusing, it could be used as a cheap stay before flying out or if you landed late and just wanted to sleep and get ready for next day. A low cost stay like this could some be very valuable during a status match challenge to rack up several nights for just a few hundred dollars.

Finally, if paying cash for a hotel, be sure to check cash back portals such as Rakuten. You can earn cash back or Amex membership reward points booking via a portal. Cashback Monitor site also shows which portals are at what rates. If cash rates are high, keep in mind that both IHG and Marriott are Chase transfer partners.

Final Thoughts

The Chase Sapphire Preferred is a great start to having a free or almost free vacation. For a solo traveler, a full Mexico trip using these dates can be as low as 66,000 Chase Ultimate Rewards. A trip for two can be as low as 88,048. That would leave you about 16,952 remaining from your CSP sign-up bonus. You could also cash out any remaining URs to pay for taxes for the flight, making the trip entirely free. Let's not forget that your spouse or partner could also get a card, meaning you could have two vacations or splurge a single trip, perhaps even extending it.

How are you using your 100,000 URs? Come share your plans for your 100,000 points in our Facebook group and learn what others are doing.