As the second largest airline in the world, in terms of fleet size, passengers flown, and air miles flown, Delta Airlines is familiar to us all. Basically anywhere you want to fly, Delta, or one of its SkyTeam partners will take you there. Given its size, it is no surprise that Delta Airlines also has a large loyalty base. Part of that loyalty is using the 6 credit cards issued by American Express. In today's article, we discuss if you should use this card or that card to earn Delta SkyMiles.

Table of Contents

ToggleDelta SkyMiles Credit Cards

Delta and American Express launched new credit cards in late 2019/early 2020. Currently, there are 6 co-branded cards from American Express:

- Delta Gold ($0 for first year, then $99 annual fee)

- Delta Platinum ($250 annual fee)

- Delta Reserve ($550 annual fee)

- Delta Gold Business ($0 for first year, then $99 annual fee)

- Delta Platinum Business ($250 annual fee)

- Delta Reserve Business ($550 annual fee)

For personal cards, the Delta Gold card earns 2x on Delta purchases, at restaurants, at U.S. Supermarkets and 1x everywhere else. The Delta Platinum card earns 3x on Delta purchases, 3x on purchases made directly with hotels, 2x at restaurants, and 1x everywhere else. The Delta Reserve card earns 3x on Delta purchases and 1x everywhere else.

For business cards, the Delta Gold Business earns 2x on Delta purchases, at restaurants, on U.S. shipping, on U.S. advertising, and 1x everywhere else. The Delta Platinum Business earns 3x on Delta purchases and on hotel purchases, 1.5x on all purchases of $5,000 or more, and 1x everywhere else. The Delta Reserve Business earns 3x on Delta purchases and 1.5x everywhere after $150,000 spend during a calendar year.

These cards come with a free checked bag and, so long as your credit card is attached to your SkyMiles account, you do not need to use the Delta card to receive this benefit. Additionally, you earn 20% off in-flight purchases.

Other Options

Delta Airlines is a transfer partner of American Express Membership Rewards (MRs). You can transfer your MRs to Delta at 1:1. There is an excise tax to transfer these points, which costs $0.0006 per point, with a $99 maximum. Note that Amex only charges this fee for MR transfers to domestic airlines. You can also use your MRs to purchase Delta flights through Amex travel. You will receive only 1.0 cents per point or approximately 1.35 cents per point with a Platinum Business, as you redeem those MRs at 1.0 cents each and then receive a 35% refund.

As a reminder, these cards earn Membership Rewards (MRs):

- Amex Platinum ($550 annual fee)

- Amex Gold ($250 annual fee)

- Amex Green ($150 annual fee)

- Amex Blue ($0 annual fee)

- Amex Everyday ($0 annual fee)

- Amex Everyday Preferred ($95 annual fee)

- Amex Platinum Business ($595 annual fee)

- Amex Gold Business ($295 annual fee)

- Amex Green Business ($0 for the first year, then $95 annual fee)

- Amex Blue Business Plus ($0 annual fee)

Of these cards, Gold and Gold Business both earn 4x at restaurants. At U.S. Supermarkets, Gold earns 4x and Everyday Preferred* earns 3x. For airline purchases, including Delta, Platinum earns 5x and Platinum business earns 5x via Amex Travel. Similarly, Platinum and Platinum Business earn 5x at hotels purchased through Amex Travel. For U.S. shipping, U.S. Gas Stations, and U.S. Advertising, the Gold Business earns 4x, but remember you only earn 4x in your top 2 spending categories each month. Additionally, the Everyday Preferred* and the Blue Business Plus earn 2x at U.S. Gas Stations. For everyday spend, the Everyday Preferred* earns 1x and the Blue Business Plus earns 2x, up to $50,000 spend each year.

(*if you use your Everyday Preferred for 30+ transactions on a monthly cycle, you earn 50% more points. Your earn then equals: 4.5x at U.S. Supermarkets, 3x at U.S. Gas Stations, and 1.5x on everyday spend.)

This or That to Earn Delta SkyMiles?

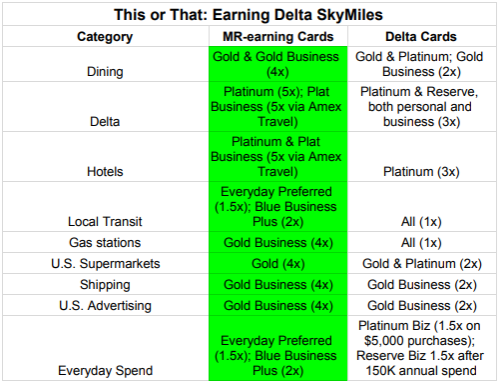

Based on the categories listed above, here is our breakdown:

There's a clear winner here and it is not even close! Bottom line: unless you are making in-flight purchases (for a 20% discount) and/or attempting to hit various spending thresholds for MQM boosts (which makes sense for almost no one), there is no reason to ever use ANY Delta card. Also remember, while earning MRs instead of Delta SkyMiles, your MRs are not tied to Delta. Instead, you can use those points as cash at Amex Travel or transfer to Amex's numerous transfer partners!

Final Thoughts

Any time you want to earn Delta SkyMiles with a Delta card, remember there is/are 1, 2, maybe even 3 or more Amex MR-earning cards that earn more Delta SkyMiles! Simply put, for almost all award travelers out there, it never makes sense to earn SkyMiles via Delta credit cards (this card). Instead, pull a MR-earning card out and swipe it instead (that card).