Travel on Point(s) has partnered with CardRatings for our coverage of credit card products. Travel on Point(s) and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

NOTE: Point Debit changes the offers without notice and some referrals may have changed.

Table of Contents

ToggleIt's not often that we review a debit card, but indeed that is what we're doing today. This is our 2022 update, as Point has made some changes to its debit card near the end of 2021. The Point debit card is not as new now, but many may not have heard of it. It has some unique offers and can be of great value to cardholders. The card is now referred to as “Neon” on Point's website as their regular “unlimited cash back” debit card.

Cardholders can earn points on every purchase, while also benefiting from frequent use during special promos called “streaks.” The points earned can be accumulated or cashed out to your account instantly. In addition, Point debit conveniently offers a physical and virtual debit card. You can load your account via another debit card or through a bank transfer.

Current Offer

Point has been know to change the referral offers without notice. Additionally, they have different offers with different spending requirements, which is a bit odd. Currently the most simple offer is:

- Sign-up Bonus: $99 in points (9,900 points)

- Requirements: $200 in spend. The cutoff appears to have a deadline based on generation or clicking of link, currently about 10-12 days

- Note that it has a virtual card as well so spend can be completed quickly

- Annual Fee: $99

TIP: I would call or message to verify your terms after signing up as well as spend date.

Earn Rate

You can view a list of merchants and how much points they earn on the Point debit card app. Some routine offers include Best Buy, Amazon, Walmart, and Costco at 5x points per dollar. Even though Point markets itself as “unlimited cash back,” bonused earning is capped among different merchants.

Point also earns:

- 5x on subscriptions, including bonus cash-back on your subscriptions like Netflix, Spotify, HBO Max, Hulu, and more

- 3x on food delivery & rideshare

- 1x on everything else

Another great way to earn points with the card are through “streaks.” Streaks offer cardholders a certain amount of points after spending a specific dollar amount over a number of days. A recent example was earning 3,000 points after spending $200 over 5 days, with a charge of any amount each of those 5 days. Simple purchases like loading your Amazon balance count as spend for a streak, and you can still earn any bonus points for Amazon (usually 5x). Streaks happen quite regularly, almost on a monthly basis.

Lastly, the Point debit card offers referrals. Once your referral uses your personal link, you will earn the amount indicated in your link. There is no cap on referral bonuses. Should you decide to apply, feel free to use our link if you do not have one.

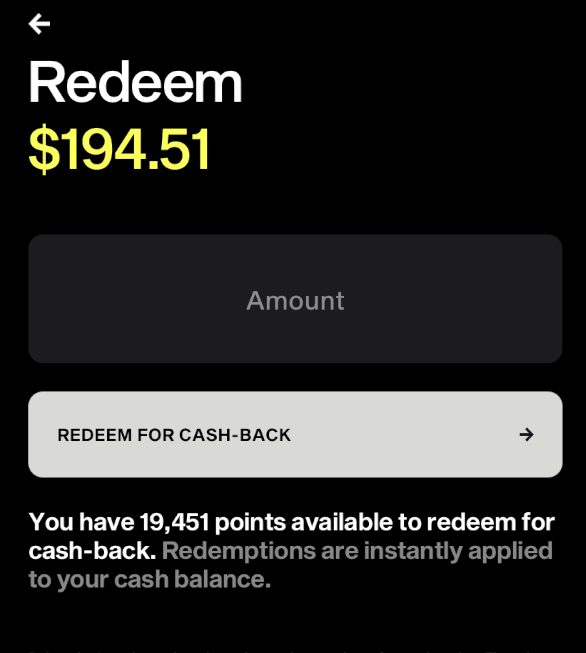

Redemption

You can redeem your points via cash out at 1 cent per point directly to your account. This means the current sign-up bonus of 9,900 points earns you $99 cash, enough to cover the annual fee.

Points from individual purchases typically post the day of the purchase. Bonus points usually post near the end of the promo period, and points from a streak will usually post within a few days of when you meet the streak requirements.

Benefits

The Point debit card also offers some valuable perks:

- Cell phone insurance (up to $1,000 per 12 months, $500 per incident, with a $50 deductible)

- New purchase insurance (up to $1,000 per purchase, with a maximum pay of $25,000 per 12 months)

- Trip cancellation insurance (up to $1,500 for expenses for cancellation/delay per incident)

- Car rental insurance

- Global travel insurance and roadside assistance when traveling

- No international travel fees

- Event ticket protection ( up to $500 insurance coverage per ticket and up to $2,000 per event)

- 2 fee free ATM withdrawals per month (reimbursed via points)

Analysis

The Point card offers a lot of value, even if you don't use it every day. Using the Point card for promotional streaks can earn you cash for purchases you would already make. You can also use the Point card for elevated bonus points at stores where the value would be only 1x, which might be greater than using a normal credit card. While the increased annual fee of $99 and referral structure change the initial profit potential, it is still possible to earn $30 or more a month in free money with streaks.

Final Thoughts

Valuable opportunities in award travel come in all forms. Sometimes, that includes a debit card. Many of us at ToP have already earned hundreds of dollars with the Point card card. Extra cash can help offset travel costs, taxes, fees, or food and beverage. This is especially true when credit card points can't cover those costs.

Are you interested in the Point debit card? Click any one of the following links to get pointed in the right direction.

Original Referral

- Sign-up Bonus: $99 worth of points (9,900)

- Requirements: $200 in allotted time. Seems to be less time but virtual card available.

- Verify if sign up process does not show time

- Annual Fee: $99

- Get pointed in the right direction!

- Get streaking with the Point Debit Card!

- Get on Point now!

- Point me to the cash now

Secondary offer

- Sign-up Bonus: $99 worth of points (9,900)

- Requirements: $200 in allotted time. Verify if sign up process does not show time

- Annual Fee: $99

Have you used a debit card to stack deals or earn free money? Want to find out more? Come over to our Facebook group and learn how we're maximizing the Point debt card.