When we begin our award travel journey, we're typically afraid of annual fees. As our journey progresses, we get more comfortable with higher and higher annual fees. Suddenly, you're faced with decisions: do you continue paying a lot in annual fees or do you cancel or downgrade cards and lose all of the valuable perks that come with them? The answer is a personal decision, but I choose “none of the above.” I let banks pay me to keep their credit cards!!! If you choose to downgrade or close cards, or you choose not to open any credit cards in the first place, you can let banks pay you money as your new “side hustle.” How? Bank account bonuses.

Table of Contents

ToggleBank Account Bonuses

Bank account bonuses are so lucrative and frequent that one of my favorite blogs, Doctor of Credit, has an entire page dedicated to the latest and greatest offers. This page is updated every month. In other pages, DoC tracks what counts as a direct deposit (hint: a direct deposit from your employer is almost never required). Done correctly, you can work on multiple bonuses at a time, especially when you aren't required to change your direct deposit with your employer. All told, you can make quite a bit of money doing this. Our best year was 2017, when we earned slightly over $2,000. In 2019, we're hoping to DOUBLE that amount.

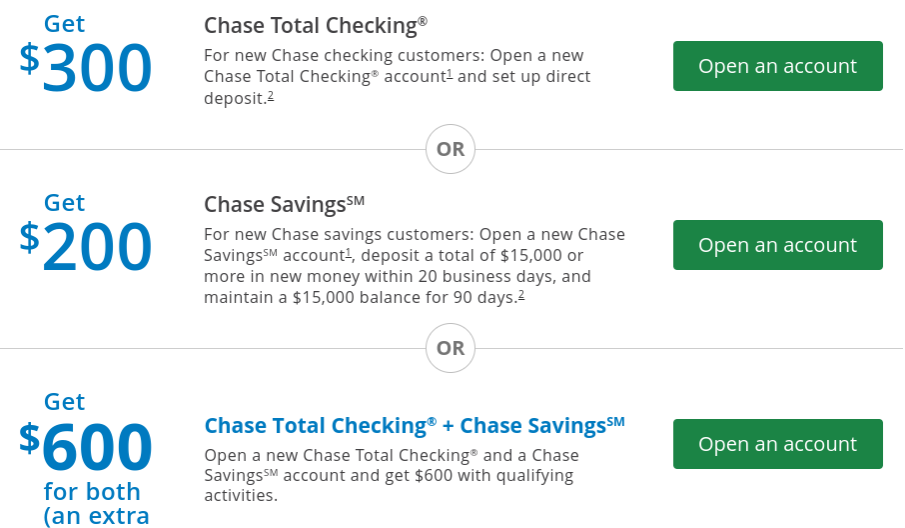

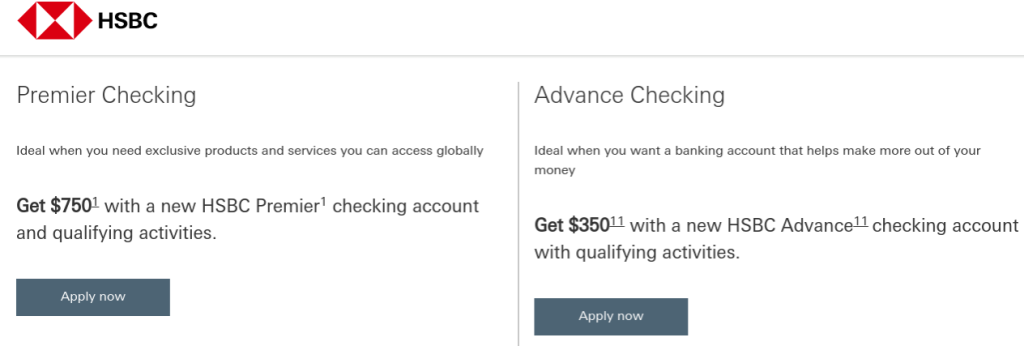

So what kind of offers am I talking about? $600, $750, and $1,000 to name a few. The sky is the limit. You can make as much money on these lucrative offers as you want, but note that the banks may send you a 1099 at the end of the year, so put some away for Uncle Sam!

Here are some of my favorite at the moment:

If you have the ability to easily change your direct deposit at work, the easiest checking account bonus is Varo. It's a mobile app and offer a $100 bonus with a $200 direct deposit. However, the beauty of this offer is the $100 bonus posts within SECONDS of the FIRST $200 direct deposit hitting. If you want to open up this account, please use my link!

Conclusion

Whether you want to open one new bank account or fifty, always consider all available offers before choosing your next bank. If you want to let the banks pay you, they will! Open as many accounts as you wish and let someone else pay your credit card annual fees and/or give you extra spending money for your next trip!

As always, leave comments below or come join our Facebook group to ask questions and give us feedback.

Travel on Point(s) has partnered with CardRatings for our coverage of credit card products. Travel on Point(s) and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.