Capital One Travel Eraser

What did he just say? Did he say he takes a measly 1 cent per point for his Capital One miles? That goes against the ToP travel commandments, doesn't it?! You are right, it does, but we also preach that this is not a one size fits out hobby. Sometimes you have to do what works for you, and using the Capital One travel eraser feature is what works best for me and my family. There is no doubt that I could get more for my Capital One miles, but I don't care, and I'll tell you why below. I'll also go over the process of redeeming your Capital One miles towards your travel expenses.

Table of Contents

ToggleBack Before They Were Really Capital One Miles

Jennifer Garner may have been calling them Capital One miles for a hot minute now, but they were not really always miles. They were a form of cash back that could only be used to redeem towards travel purchases. That is where the Capital One travel eraser moniker came from. There was another competitor card in the same realm, the Barclays Arrival+, which has since been discontinued. Those two products were at a disadvantage once 2% earning cards hit the market though. Why would you pick a card that has an annual fee, which the 2% cards didn't, and have a more restrictive currency versus cash back?

It was a problem that Capital One was smart to notice. They decided to lean fully into the transferrable currency market and then launched their own premium lineup of cards a little while after, the Venture X and Venture Business X.

Once those transfer partners were added, now 18 in total, the miles became more valuable overall. It was now possible to get a better return than those 2% cash back cards when redeeming your miles in this way. Plus, you could still take advantage of the Capital One travel eraser system when needed. Their cards now offered you the best of both worlds so to speak.

The truth is the updated program, while great for some, never really moved the needle for me. Over the last several years I have continued to “cash out” my Capital One miles on travel purchases.

Two Reasons Why 1 Cent Per Point Is Good Enough For Me

There are a few different reasons that I continue redeeming my Capital One miles towards travel expenses. I'll go over each in a bit of detail for everyone. The important thing to remember is you have to do whatever fits your needs and accomplishes your travel goals best. Even if that goes against the grain of maximum value at times. While we aim for our advice to be the best option for most people in the ToP Facebook Group, we understand that at times that you will have different needs that we are not aware of. You just have to be honest with yourself about what you are giving up to go the road less traveled.

Capital One Transfer Partners Don't Excite Me Much

The first, and likely most important portion of this, is that the Capital One transfer partners don't impress me much. Do you have Shania Twain ringing in your head right now too? The truth of the matter is that Capital One's partners are mostly made of the most promiscuous of travel brands. They are the airlines and hotels programs that give their points and miles out to anyone who is asking. The lone unique option was TAP, which is now a partner of Bilt as well.

Outside of that, these are heavily overlapped programs included in other currencies' lineups. That offers some value based on the fact that you can use Capital One miles instead, which allows you to save your other, more valuable, currencies for more rare transfer partners. Think of transferring Capital One miles to Aeroplan to save your Ultimate Rewards for Hyatt etc. There is value there, but I earn enough of the other points that I don't really worry about robbing Peter to pay Paul.

The Miles Allow Me To Travel Splurge

Now that you know that I don't really value the Capital One transfer partners, we need to talk about what I actually use my Capital One travel eraser redemptions on. This is where I like to splurge on things that I am unlikely pay cash for. While money is fungible (as Sarah loves to say), Capital One miles are not truly a cash currency. While there are ways to blur that line, I value them as a bit less than true cash back. Because of that, I look here first for travel purchases versus hoarding my Capital One miles for a better transfer partner booking.

Thinking about Capital One miles in this way allows me to do things I would probably never do otherwise. The redemptions have also lead to some of my greatest travel memories. Here are some reason redemptions I have had using the Capital One travel eraser:

- VIP tickets to Universal Hollywood with my son.

- I bought via Undercover Tourist so it codes as travel, since buying direct does not.

- Upgraded to first class for a flight home when I was tired from a weekend of fun

- Paying for the 4 night Sheraton Timeshare offer that required no timeshare presentation

- Upgraded to a suite at the hotel for extra space for the family so we were more rested the next day

- A massage for my wife in Hawaii at the Hyatt Hana Maui

- Countless dinners and drinks while staying at a high end resort

I still need to write up about our VIP experience at Universal. Such an amazing time with my son that I would have never paid $450 a person for out of pocket.

How To Use The Capital One Travel Eraser System

Another thing I love about redeeming my Capital One miles towards travel is how easy it is. With a couple clicks you can redeem your points and erase that travel purchase. You have 90 days to go back and wipe it off. This allows you to make the purchase before you have the points to cover it. You even earn points on the purchase to use towards the travel eraser when you wipe it off! This may be extra beneficial during the welcome offer period if you are using a large travel purchase towards the minimum spend. Here is our step by step guide on using the Capital One travel eraser:

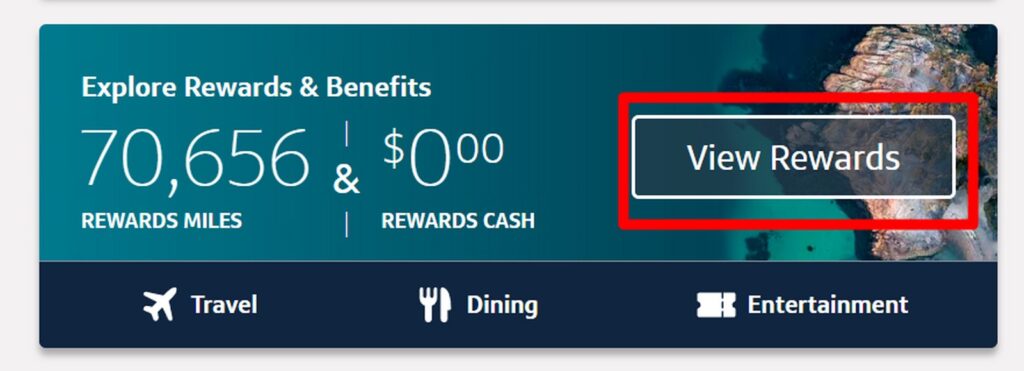

Step 1: Go To Your Rewards Section

First up, you will want to go to your Rewards Section in your app or on your desktop. This is usually found underneath your cards and bank accounts.

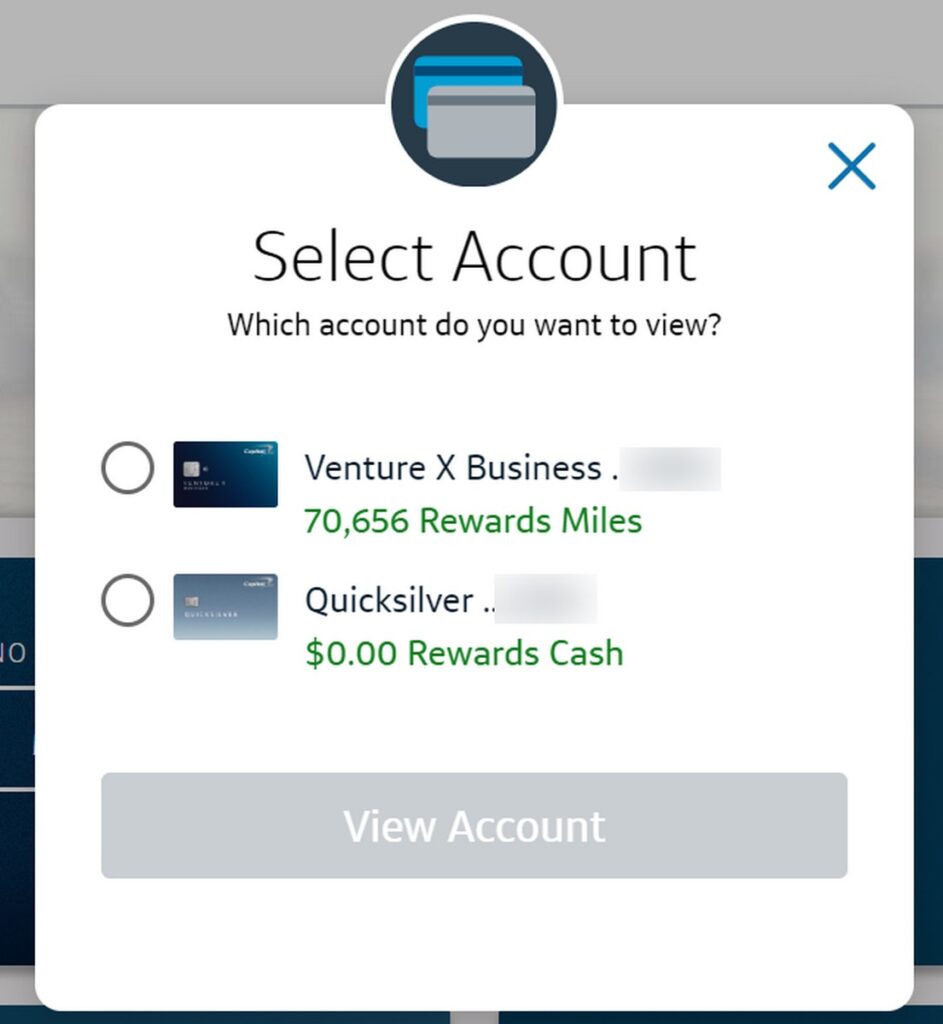

Step 2: Select Which Awards Account You Would Like To Use

If you have more than one Capital One card you will need to select which card's rewards balance you want to use.

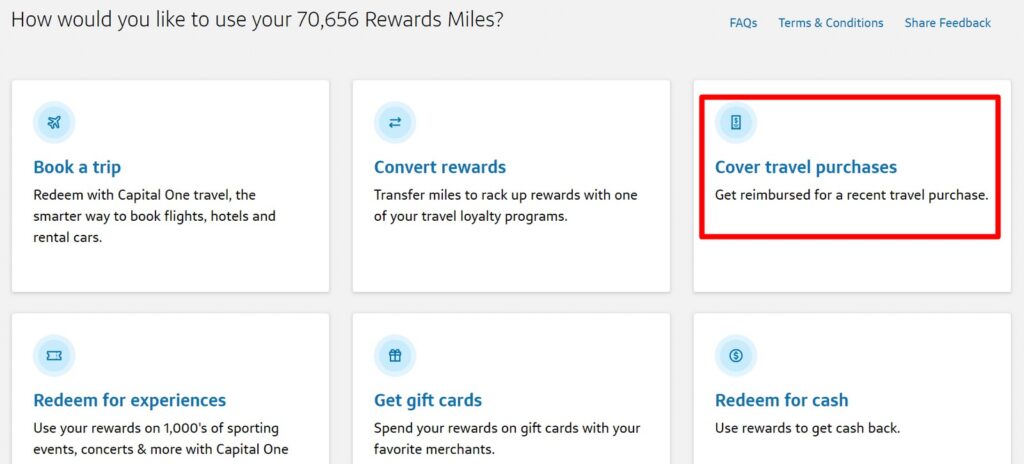

Step 3: Select That You Want To Cover Travel Purchases

After you select the card's rewards you want to use you will need to select to Cover Travel Purchases. This is one of several options you will be presented with. This is also where you can transfer miles or book via the Capital One travel portal etc.

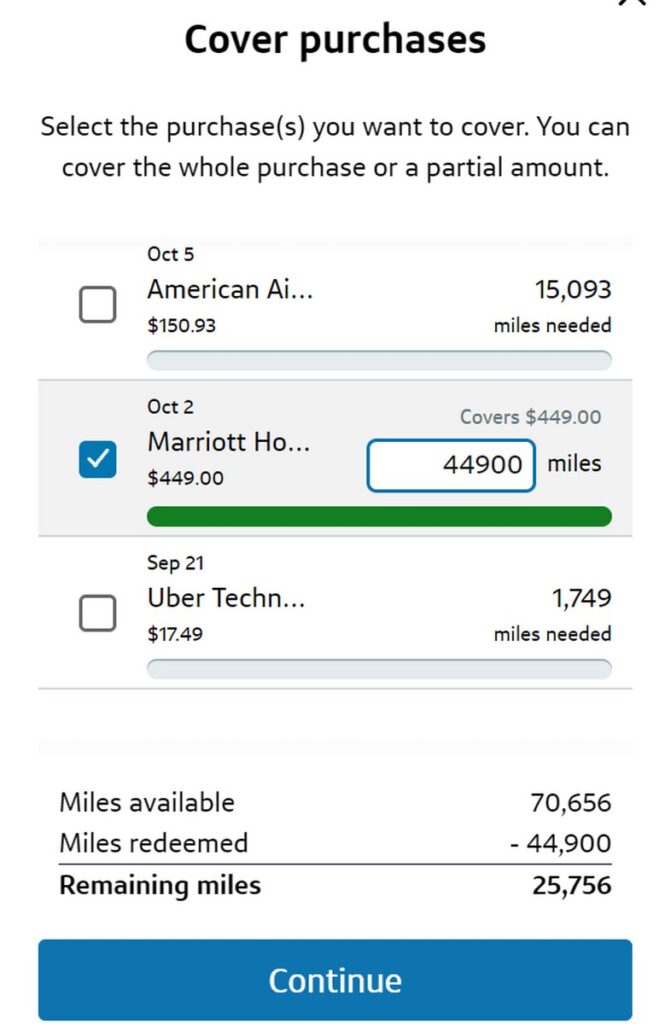

Step 4: Select The Charges You Want To Use The Capital One Travel Eraser On

The last step is selecting the charges you want to redeem your Capital One miles towards to use the travel eraser function. You can select more than one charge at once, and you can even designate how much of each charge you want to cover. Only eligible purchases within the last 90 days will appear here as an option.

Capital One Travel Eraser: ToP Thoughts

Whether or not you use the Capital One travel eraser function will depend on several things. It will depend on how many miles and points you have elsewhere, what kind of earning rate you have each year and what your future travel plans look like. It could also depend on if you are more points rich or cash rich too. While it is far from the best option for my Capital One miles it is the best choice for me and my family. It allows us to punch above our travel weight class so to speak, and allows us to do things we would never do otherwise.

Let me know if you ever use the Capital One travel eraser function over in the ToP Facebook Group.