American Airlines 50X Promotion

Fifty points per dollar?! Seems like a no-brainer, right? As a famous NCAA football announcer says “not so fast, my friends!” The current American Airlines 50X promotion is not as good as it seems and requires a bit of math (gasp!). But, before we do a deep dive on why you might want to wait for a better opportunity, we outline the promotion itself.

Table of Contents

ToggleUpdate 10/18/24: We are getting reports that the miles are finally posting for people that used the promotion.

Details of the Promotion

From now through September 30, 2024, or when $3,000,000 is donated on a qualifying card, whichever is earlier, you can earn 25x or 50x American Airlines miles through donations to Stand Up to Cancer. The exact details are this:

- receive 25x American Airlines miles per dollar on a donation of $25 or more

- receive 50x American Airlines miles per dollar on a donation of $25 to $10,000 on an American Airlines AAdvantage Mastercard

Note that these are bonus miles and will not count for loyalty points for status.

Terms & Conditions of the Promotion

The terms & conditions of the American Airlines 50x promotion are where things take an unexpected turn. The terms include:

- All donations are nonrefundable

- Bonus miles do not count toward status qualification (i.e., loyalty points)

- Miles may take up to 12 weeks to arrive in your account

- For charitable deduction purposes, each mile is valued at $0.03, which may reduce the tax deductibility of your contribution

- If your credit card account is closed for any reason, you may not be eligible for this offer

To Buy or Not to Buy?

First things first, we love donating to charity. Everyone at ToP whole-heartedly supports charitable giving. In fact, Travel on Point(s) donated to this promotion and the Maui Relief promotion with American Airlines a few weeks ago. However, this American Airlines 25x to 50x promotion is more complex than it seems. We have two glaring issues here:

- First, is this donation tax deductible?

- Second, does the math make sense to buy American Airlines miles if that is your main goal?

You heard that correctly, we have to do some actual math.

Is this a Tax Deduction?

For tax deductibility, we suggest that you talk to a tax professional for advice specific to your circumstances. However, if you are donating with an American Airlines Mastercard, and earning 50x, the terms of the promotion clearly state you receive $1.50 of value for each $1.00 donated. It is hard to argue there is anything to deduct at this point. If you are not using an American Airlines Mastercard, and earning only 25x, you receive $0.75 of value for each $1.00 donated. While there is a small tax deduction possible, it looks like it will be reduced by 75%. From our own experience, no “gift receipt” email was sent and no email confirmation of the donation amount at all, making any tax deductions more difficult to document.

What Does The Math Say?

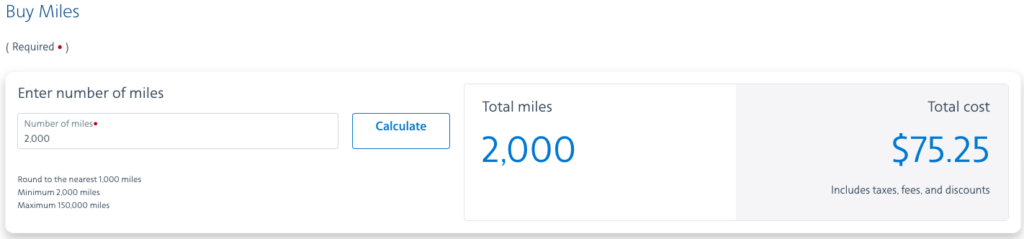

To tackle the math question, this requires serious number crunching. Without any promotion in place, either for a donation to a charity or for buying miles outright, anyone can buy American Airlines miles at any time, whether or not you should, for $0.0376 cents each. Since American Airlines processes its own mileage sales, you earn between 2x and 5x American Airlines miles per dollar on an American Airlines credit card. When factoring in the value of those miles it reduces the overall cost to $0.0316 to $0.035 each.

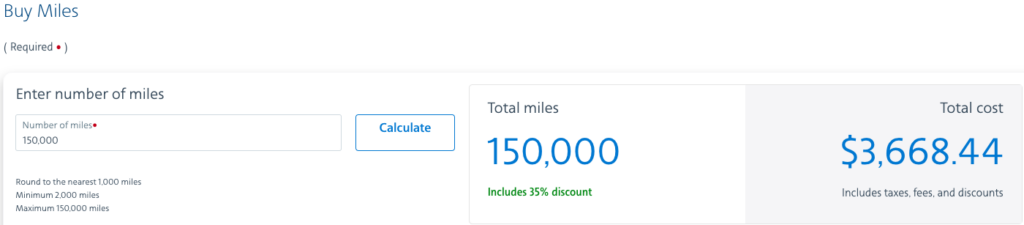

But the math changes even more, as American Airlines regularly runs sales of 35%, 45% or 50% off. The current promotion is 35% off, but higher sales happen often. At 50% discounts, you can buy miles outright for under 1.9 cents each.

Let's look at some examples comparing the two options for both levels of the Stand Up To Cancer promotion.

150,000 Miles At 25X vs Buying Directly & Donating Money

For the 25x part of this promotion, which assumes you are NOT donating to Stand Up To Cancer on an American Airlines Mastercard, you receive 25x American Airlines Miles. This is like paying $0.04 per mile and, most likely, losing 75% of the donation amount in tax deductibility. If you were to buy miles during a 50% off sale, you can actually get them for much cheaper. Here is an example:

- Donate $6,000 to Stand Up To Cancer and receive 150,000 American Airlines miles.

- Tax deductibility of the $6,000 is likely reduced to only $1,500.

- Tax savings for an average American family (20%): $300.

- Tax deductibility of the $6,000 is likely reduced to only $1,500.

- Buy miles from American Airlines for $2,821.87 during a 50% off sale and receive 150,000 American Airlines miles (plus up to 5x transferrable currency for an airline purchase on an award travel card).

- Donate the remaining $3,178.13 to any charity and receive a full tax deduction for your donation.

- Tax savings for an average American family (20%): $635.63.

- Donate the remaining $3,178.13 to any charity and receive a full tax deduction for your donation.

By waiting for a sale you would get a the same amount of miles and a better deduction overall, although less money would be going to charity.

150,000 Miles At 50X vs Buying Directly & Donating Money

Regarding the 50x American Airlines promotion, you receive 50x American Airlines miles for donations. This is paying $0.02 per mile and, likely, losing ALL of the donation amount in tax deductibility. The math in this example is as follows:

- Donate $3,000 to Stand Up To Cancer and receive 150,000 American Airlines miles for the donation and 3,000 AA miles for the credit card charge.

- You would get $0 in tax savings

- Buy miles from American Airlines with an American airlines card ( like the Executive card earning 5x miles) for $2,728 during a 50% off sale and receive 150,000 total American Airlines miles from purchase and card spend

- Donate $272 to a charity of your choice.

- Tax savings to the average American family (20%): $54.40.

- Donate $272 to a charity of your choice.

There is no real difference between the two and a ton more money goes to charity in this case.

What If You Were Just Redirecting Money From Your Normal Charitable Givings?

While we have looked at it from the angle of buying American Airlines miles being the main driving force, but what if you were already going to donate the money anyway? We are not going to discuss moving money from one charity to another and how the affects things, that is a personal decision, but what the real cost is to you, if anything.

Let's say you normally have $5,000 earmarked for charitable givings each year and you rotate which charities you support each year. Then this looks like the perfect deal, until you realize that you are not getting the full deduction. Does that really matter with the American Airlines miles earning? Let's take a look:

Donating $5,000 Without An American Airlines Card (25X)

- Donating $5,000 with the 25X promotion would net you 125,000 American Airlines miles

- Those miles are worth $1,875 if you value them at $0.015 each.

- You would also likely get a $1,250 deduction which is worth around $250 in the 20% bracket.

- Total value is $2,125 vs the $1,000 you would get on the tax savings at 20%

Donating $5,000 With An American Airlines Card (50X)

- Donating $5,000 with the 50X promotion would net you 250,000 American Airlines miles

- Those miles are worth $3,750 if you value them at $0.015

- You would get no deduction with this offer

- Total value of $3,750 vs the $1,000 you would get on the tax savings at 20%

You of course should plug in your own tax bracket numbers. If the normal donations you makes lowers you a tax bracket etc., that is a more significant calculation.

All things being equal, if you have money earmarked for donation each year, and you haven't decided where to place it yet, then this looks like a great option. It will likely give you a much better return versus your normal tax deduction, and the full amount of money still goes to charity.

American Airlines 50x Promotion: ToP Thoughts

See, we told you this promotion was much more difficult than it appears. Once you factor in the cost to buy miles, and the unlikelihood of any tax deductions, the decision isn't so easy. Ultimately, this comes down to whether your main motivation is buying American Airlines miles, or if you had money earmarked for donation already.

If your main goal is to earn American Airlines miles I do not think the math makes sense to do this deal at the 25x level. You're better off waiting for a mileage sale and then using the savings to donate to any charity you choose. For the American Airlines 50x promotion, it is probably worth it if you were planning to donate to this charity.

Buying miles outright for 2 cents per point is not worth it a majority of the time, but it may make sense for you! It made sense for ToP and we donated generously to Stand Up To Cancer.