Should I Buy Travel Insurance?

Here at Travel on Point(s) we support our members in traveling the world. Often times, our members are able to increase their travel habits exponentially. It is very common to see a once-a-year traveler become a once-a-month traveler here in ToP. As you ramp up your travel, a question often comes up. That question is whether or not you should purchase travel insurance. While this is a deeply personal question, we will discuss many of the main considerations to make this decision just a bit easier for you.

Table of Contents

ToggleRELATED: Read Terms Carefully: Our Allianz Travel Insurance Debacle

What is Travel Insurance?

Just like home insurance or car insurance, you can purchase insurance for your travels as well. Similar to another policy you may have, deciding to purchase insurance involves understanding what coverages you want and purchasing the best option for you. Insurance helps to kick in for covered reasons if you experience issues while traveling. Most travel insurance policies include coverages such as baggage delay, trip delay, trip cancellation and trip interruption. These coverages can be helpful to reimburse you for unexpected travel expenditures.

Single Trip versus Annual Plans

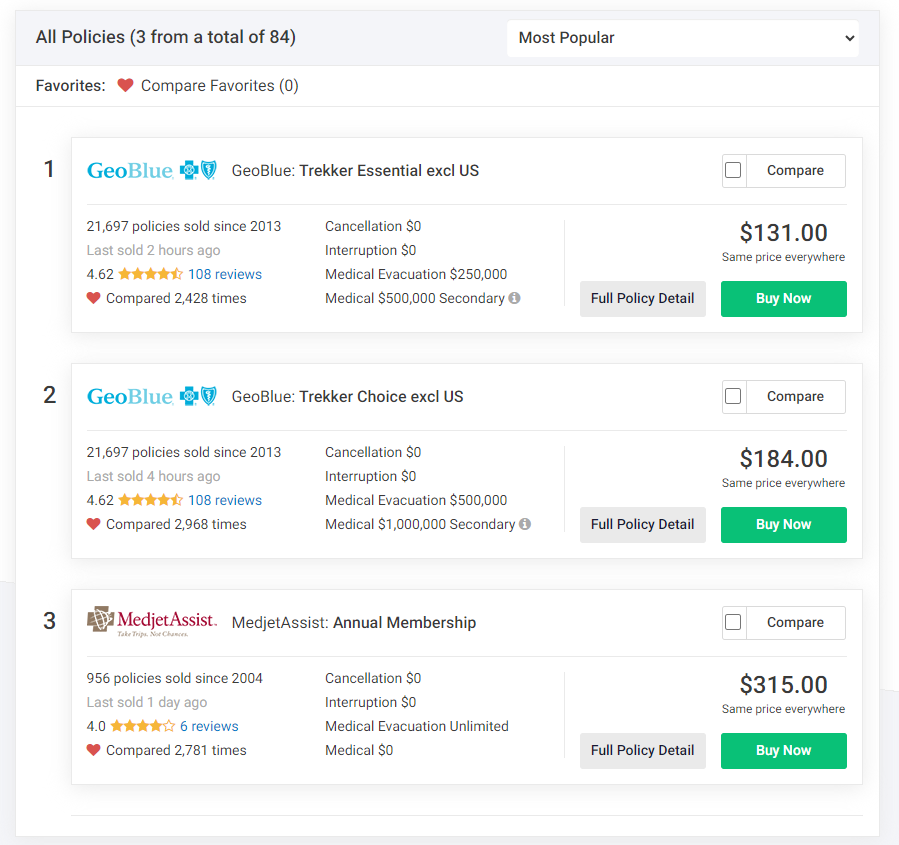

Similar to car insurance, travel insurance also comes in different forms. You can purchase single trip or annual travel insurance plans. An annual travel insurance plan is often the most economical plan if you travel more than a few times per year. Allianz is the main provider of annual plans. However, SquareMouth is also a helpful resource in comparing many plans at once.

Risk Appetite

One of the major components of deciding to purchase any insurance is your risk appetite. What is risk appetite? Your appetite for risk is quite simply how much risk, usually financial, you are willing to take. When considering travel insurance, are you willing to accept a $1,000 loss if you go uninsured? Taking a look at your actual travel for the coming year, and then determining what the largest possible loss is can help you determine if purchasing a policy is within your risk appetite. For example, if you have no travel planned for the coming year, then your largest probably loss is $0; it is not worth buying insurance. However, if you travel multiple times per month and could anticipate losses over $1,000 due to travel issues, then it is possible that purchasing insurance is worth it for you.

Your Travel Patterns

Another important consideration when purchasing travel insurance is your travel patterns. Are you the weekend warrior who is constantly hitting the road? Or are you taking one large trip per year? Understanding what your actual travel habits are can help inform your decision. Further, on your travels, do you normally take a lot of flights where having flight coverages will be important to you? If you are usually a road-tripper, then perhaps insurance does not help you much. The bottom line here is that knowing your actual travel habits can help you make the right decision for your needs.

Your Lifestyle

Depending on your lifestyle and your health, you may have greater or lesser concerns while traveling. If you have health concerns or suspect that medical emergency is a possibility, having sufficient coverage to protect you in those cases can be paramount. Of course we always hope nothing will happen, but having those coverages can help provide peace of mind when setting out on journeys near or far.

What Card Benefits Already Cover You

The final component I recommend considering is what card benefits you already have. Many credit cards, such as the Chase Sapphire Preferred & Chase Sapphire Reserve provide travel insurance benefits. By charging eligible travel to a card with travel benefits, you receive included travel insurance coverages. Because of this, it may not be necessary to purchase additional insurance. Reviewing these benefits prior to obtaining insurance can tell you if you already have sufficient coverages at this time. Because of this, we highly recommend retrieving your cards guide to benefits and reviewing it to ensure you know what coverages apply.

Below are many common credit card's travel insurance guide to benefits:

Purchasing Travel Insurance: ToP Thoughts

Deciding whether or not to purchase insurance for your travels is a deeply personal decision. Understanding your needs for insurance can help you make the best decision for your situation. Each individual has to evaluate their travel habits and risk tolerance. Plus, there are many travelers out there that have greater concerns than others. Finally, considering if your card benefits already have your insurance needs covered can help save you from purchasing excessive insurance.

Did you decide to purchase insurance for your award travel? Let us know over in the ToP Facebook Group.