Charles Schwab Debit Card

Here at Travel on Point(s) we talk a lot about credit cards. We recommend using a credit card for all your daily expenses in order to earn points. There are times, however, that you need to pay for things in cash during your travels. That is why there is in fact a debit card we think you should add to your wallet. Say what?! It's true! The Charles Schwab debit card is a traveler's best friend, and is perfect for anyone looking to use ATM's while traveling. In this article, we will break down why the Charles Schwab debit card is a huge tool for your travel toolbelt and how to go about getting one for yourself.

Table of Contents

ToggleHow Do You Get One For Yourself?

In order to get the Charles Schwab debit card, you have to open a Schwab checking account and Brokerage account. Both of these are conveniently opened at the same time.

- Both accounts have no monthly service fees

- Both accounts have no minimum balance

- The account is fee free including ATM fees and foreign transaction fees

- Link To Set Up Your Account

I just want to reiterate that you do not have to place any minimums etc. when opening the Charles Schwab checking account to get your ATM card.

Why You Should Get this Card

Now that we know how to get the Charles Schwab debit card, let's get into the details on why you should never leave home (or the US) without it.

Reason 1: ATM Fees

Both obvious and amazing, one of the most compelling reasons to get this card is to waive all ATM fees. No one likes paying ATM fees when taking cash out. I try to avoid using cash whenever possible. However, when abroad there are still many places that you will reasonably need some cash. Having this card makes those moments more ideal. Point blank, the Schwab debit card reverses all ATM fees. This is remarkable, and even includes the fees an ATM charges you (as a non-customer of that bank) to use their ATM. It's truly a great perk!

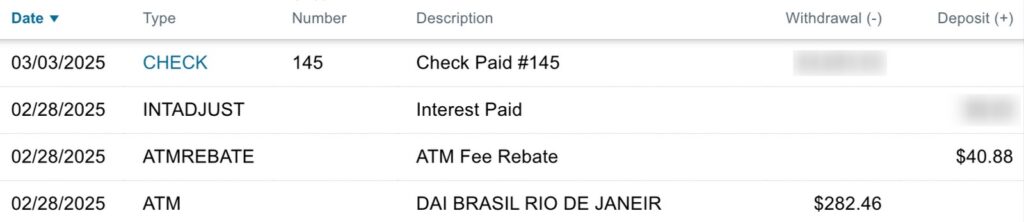

These ATM withdraw fees can really start to add up, making the savings this card presents even more valuable. There is no cap to how much fees you can have waived. Take a peek at the screenshot below. On a recent withdrawal of around $280, Derrick was able to receive a rebate of nearly $41 while in Rio. This can really be significant and it appears the sky is the limit!

Word Of Caution:

I should note, as a word of caution, new accounts with Schwab tend to hold deposits for up to 10 days. Make sure to make your deposits well in advance of heading off on your trip to avoid any issues with using your Schwab debit card.

Reason 2: Charles Schwab American Express Platinum Card

Another compelling reason to open a Schwab brokerage account is because it opens up access to the Charles Schwab American Express Platinum card. That is right, there is a Charles Schwab flavor of the American Express Platinum card.

While American Express recently added family language to the Charles Schwab Platinum card, it still has some benefits that other versions don't. The real perk of this card (on top of the perks that every version of the Amex Platinum get) is the ability to cash out your Membership Rewards points at 1.10 cents a piece. That is below value for many redemption values for your Membership Rewards, however, cash is king for many. If you earn more Membership Rewards points than you can use traveling then this may be a good perk for you.

Charles Schwab Debit Card: ToP Thoughts

While using credit cards for spend is the tried and true way to Travel on Point(s), there are some instances where cash talks. When travelling there will be times where cash is needed. By having the Schwab debit card in your wallet you can make taking out that cash a little less painful. Having absolutely no ATM fees is amazing, and the fact that they even rebate other banks ATM fees is fantastic. This card should be in every travelers pocket! If you decide to grab this card, tell us about it over on our Facebook group!