American Express Excise Tax

Transferring points is an important cornerstone of award travel. Award travelers are able to use transferable currencies to book the best award flights. Annoyingly however, American Express imposes an excise tax offset fee for certain transfers. Award travelers that intend to transfer points may have been surprised to see that pesky fee. After all, we have gotten used to transferring points at no cost. The good news is that there is a very simple way to avoid these fees. In this article we will explain what the excise tax is, why it's charged and how to avoid it.

Table of Contents

ToggleWhat is an Excise Tax?

An excise tax is a tax that is imposed on specific goods, services or activities. Differing from a sales tax, an excise tax is typically charged not upon sale, but upon production of the good/service. In the case of loyalty points, the tax is assessed when points are transferred. The points transfer, is essentially your “production” of something of value. As such, Uncle Sam wants his cut. According to Stripe, “Excise tax is charged when a product or service has an unintended consequence that should be accounted for but is not reflected in the price of the item”. Essentially, an excise tax is a tax that seeks to put monetary assessment on the unintended consequence of loyalty program transfers.

Why Is There An Excise Tax on Frequent Flyer Miles?

Since 1997, a federal excise tax has been imposed on mileage awards used to redeem for taxable airline transportation. A federal transportation excise tax was and is already charged on cash bookings within the United States of 7.5%. If you purchase a cash flight – you will notice the US Transportation Tax line item on your receipt that amounts to 7.5%. The problem was that the IRS realized that award tickets subvert this fee, since there is no cash value assigned to the receipt – it is being paid for with miles. Because of this, the IRS added this provision for the excise tax to apply to frequent flyer miles as well.

When Is the Tax Imposed?

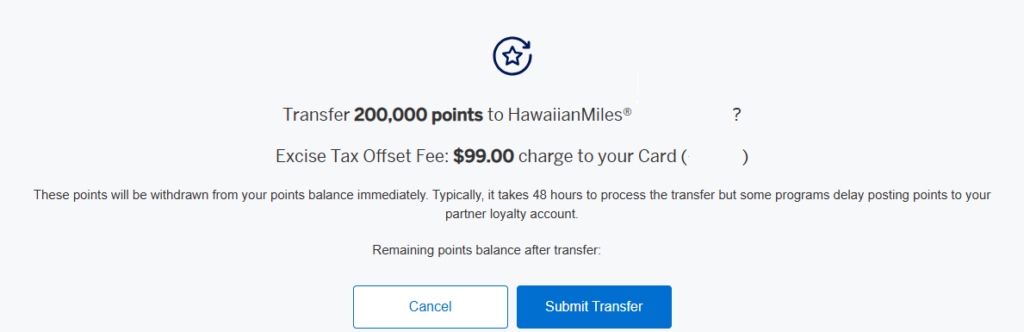

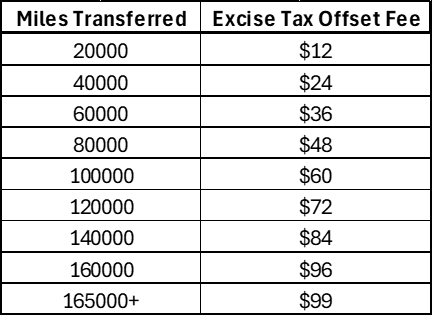

Firstly, this tax will only be passed on to you with transfers from American Express. Why? Because while other banks decide to “eat” this cost, American Express decided to pass it on to the consumer. In it's own Membership Rewards terms, Amex states, “This fee offsets the federal excise tax we must pay when you transfer points,”. Secondly, this tax will only be charged by American Express for any transfers to domestic airline partners. This means that transfers to foreign airline partners are NOT assessed this fee. It also means that transfers to hotel partners, domestic or foreign, are not assessed a fee. The fee to transfer is $0.0006 per point, up to a maximum fee of $99. See below a chart of the fee you can expect to pay for various amounts transferred.

How to Avoid the Excise Tax Offset Fee

Avoiding the excise tax offset fee is pretty simply to do, and you have some options. Firstly, you can consider using points other than American Express to transfer. Other banks do not pass on this fee to you as the consumer, so if you want to transfer to a domestic partner than another bank has access to, consider using that bank to do so. You can reference our partner transfer tool here.

Secondly, you can decide to transfer to a foreign transfer partner instead. For example, in order to book a Delta flight – rather than transferring your points to Delta, consider checking Virgin Atlantic to see if your flight is available there. You will not pay an excise tax fee for transfers to foreign airlines. See our guide here for some creative options to book domestic award flights.

With transfers from American Express –> Hawaiian Airlines –> Alaska Airlines still currently available, it is important to note that there is no way around the excise tax fee here. If you want to transfer to Alaska Airlines indirectly, it may be worth paying the excise tax fee.

American Express Excise Tax: ToP Thoughts

American Express passes along an excise tax for transfers to domestic airline partners. The fees, while nominal, can be an unexpected cost to award travelers that aren't aware of it. The fees ToP off at a maximum of $99 per transfer. To avoid the tax, you can consider using another bank to transfer from, or a foreign airline transfer partner. Finally, there are many cases where paying the excise tax fee is a necessary evil. Have you been surprised to pay an excise tax fee? Let us know over in the ToP Facebook Group.