Capital One Account Restriction Notice

A few weeks ago I opened up my Capital One app to check something on my Venture X Business card and my stomach instantly hit the floor. I was smacked in the face with a Capital One account restriction notice warning. The natural thing is to think the worst, and assume this meant that there was something wrong with my account. As I'll show you, that wasn't the case at all. At least not if you follow what they tell you to do. And, even if you do, the message doesn't go away. To be honest, I found that just as concerning as the initial notice. I'll get into all of that though, and explain why I am glad I was a bit nervous about the entire situation.

Table of Contents

Toggle

What Did The Capital One Account Restriction Notice Say?

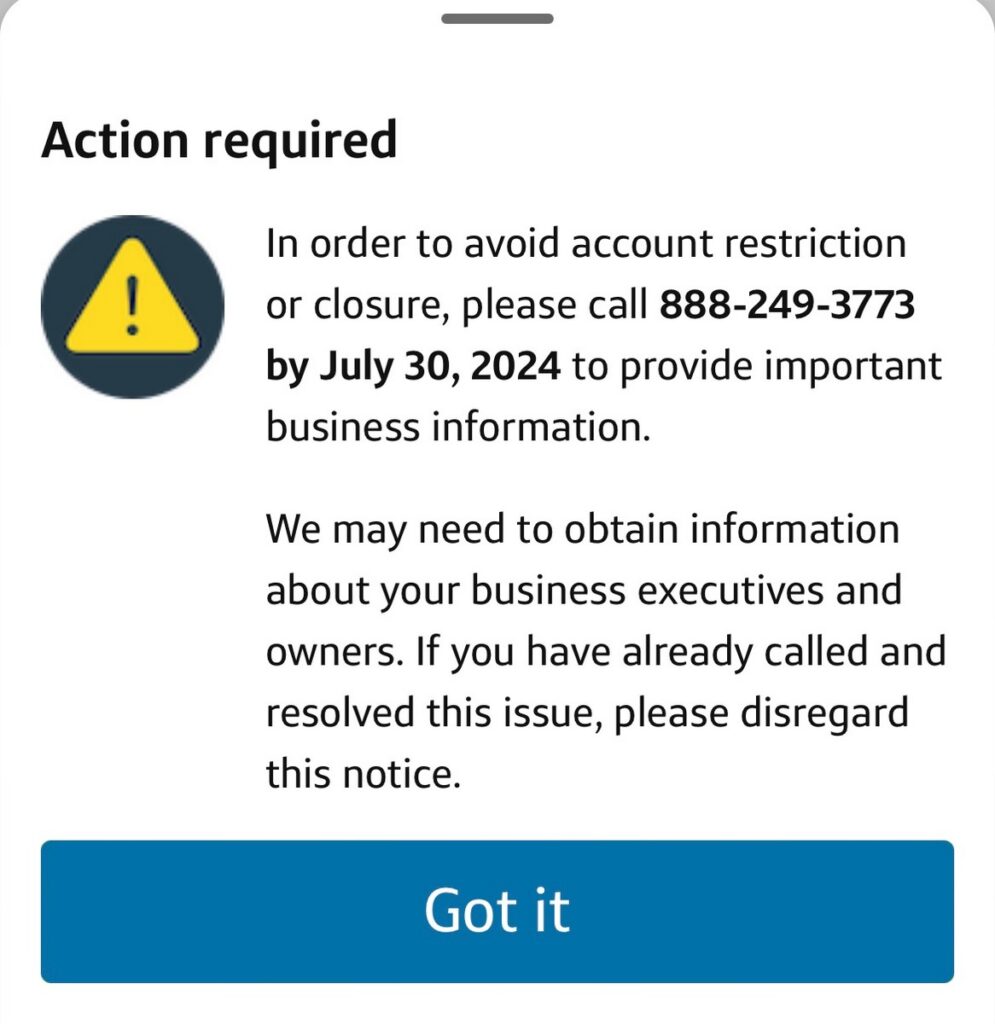

When I logged into my account I was served up this account closure warning notice. Annoyingly, it has continued to pop up every so often when I open my Capital One app. More on that later though. Here is what the notice has said each and every time:

Action Required

In order to avoid restriction or closure, please call 888-249-3773 by July 30th, 2024 to provide important business information.

We may need to obtain information about your business executives and owners. If you have already called and resolved this issue, please disregard this notice.

What Happened When I Called The Number

I called the number later that first evening. I was connected with a nice rep and explained that I had received the notice and was told to call in. She proceeded to ask me a lot of questions about my business. The usual stuff you would expect when applying for a new account. Things such as what was the business address, how many employees and how the business was set up (sole prop / LLC etc.). This went on for around 20 minutes, or so, until she thanked me for my time and said we were all set.

All this happened without an explanation of what exactly was going on. When she was done I asked the pertinent question, so what was all of this about? That is when she left the phone for a minute to get some memo that she read to me. After a ton of lawyer speak, saying a bunch of nothing, I asked is this just a know your customer thing? She chuckled, and then said – exactly. That is when I thanked her for her time and hung up.

What Is Know Your Customer

Here is what Google had to say about Know Your Customer:

A Know Your Customer check is the mandatory process of identifying and verifying the client's identity when opening an account and periodically over time. In other words, banks must ensure that their clients are genuinely who they claim to be.

I am guessing it was just my time, or I passed a certain spending threshold that trips such a thing. They need to file things like this in case the government comes knocking. That is why they had the harsh language with the account restriction notice to get people to call in.

Why Did I Continue Getting The Capital One Alert?

Why did I continue to get this Capital One account restriction notice after completing the call? I figured their system was just delayed in updating my response at first. As the deadline got closer I started to feel uneasy about it all. That is when I decided to call the number again and make double sure I was all set.

Another rep answered the second time I called and I explained my concern. She said that the message was just set to come up continuously until the timeline passed. Those bank IT systems doing us favors again! She then asked if I would like her to check my account to see if I was in fact all set.

I agreed, and that is when she asked me a few more questions about my business. Then she commented that it was good that I called in to check on everything, since it appeared a few things were missed or put in wrong. Uh, what?! I would have been so irate if my account had been suspended, or closed, because their rep didn't do everything they were supposed to do. Let's hope that this time around they did it right. I guess I will find out for sure in a few days.

Capital One Account Restriction Notice: ToP Thoughts

I have a feeling that more and more people will see a Capital One account restriction notice on their account over time. Because of that, I figured it was worth writing about my experience so you know what to expect. It can be scary at first, since you don't know what is going on, but it seems like a pretty standard Know Your Customer requirement banks need to do from time to time. In other words, have no fear and pick up that phone!