How To Use Melio

Melio is a payment processing service that allows small businesses to make payments to other businesses using their platform. Melio can help unlock credit card payments to vendors that do not accept card payments. This is because the service accepts payments via bank transfer for free, or using a credit card for a fee to then pass along your payment to the recipient. This makes Melio an incredible tool to unlock credit card payments to vendors that would otherwise not accept card payments. This service is a great choice for helping to meet minimum spend. Because of that I wanted to go over how to use Melio and also share a ToP exclusive offer for the service.

Table of Contents

Toggle**The links in this article have been independently collected by Travel on Point(s) and are an affiliate link. If you choose to use them then we may receive compensation. Thank you in advance if you choose to use them to support ToP.

Update 4/5/25: This $200 offer is still available!! There are new pricing structures and subscriptions which we outline below.

Mark’s Experience

Mark tried the service before Melio offered a subscription model. He shares his experience, and we expect it to work similarly for this new offer: “My wife and I each signed up for an account and made a payment over $200. We did it on 2/7 and 2/15 and were both paid our bonus on 3/11. It sounds like they go out in batches once per month. We both set up our checking accounts as the receiving method for vendor payments and were able to respond to the email to use that information (details on how to do it should be in your bonus email).“

Why You Should Use Melio Pay

Before we get into how to use Melio, we should discuss what exactly Melio is. Perhaps you are staring at a bill, and you see the big scary words: cash or check only. Of course, you are wishing you could optimize paying that bill by earning some credit card rewards. This is where the power of Melio can come into play, since they process the credit card and then forward on the payment. The service allows you to earn rewards on payments you otherwise would not be able to. Melio calls this service Melio Pay. Melio Pay is accounts payable software that allows you to pay any bill with a debit or credit card. In fact, Melio touts itself as the ‘Venmo for businesses' which I find to be a funny yet accurate description of the service. It boils down to being able to pay your vendors as easily as you could pay your friends through Venmo.

Sign Up For Melio With ToP Exclusive Offer

Account Details

Let's talk about the dirty details of signing up for a Melio account:

- Melio has a subscription model for new accounts:

- The Melio Go subscription is free to sign up for and includes some free features.

- The Melio Core and Melio Boost subscriptions offer additional features for a monthly fee. More about this below.

- You can pay vendors that only accept checks.

- Melio will accept your credit card and then remit a check to the recipient.

- Melio's fee for processing a credit card is 2.9%.

- This CC processing fee includes cutting and mailing of the checks to vendors, reducing effort and time on your end.

While there is a fee for using a credit card, the fee is well worth it while working on a welcome offer on a new card, or potentially if working on a spending offer.

Melio Go is ideal for small businesses that only need access for one user and will make 5 or fewer ACH payments per month.

Melio Core is ideal for small businesses that need more features than Melio Go, including the ability to add additional users for an additional fee, 20 free ACH payments per month, and integration with accounting software.

Melio Boost, as you might expect, is the premium subscription and offers the most features including the same benefits of Melio Core, 50 free ACH payments per month, and premium support.

Pricing and plan details can be found here. **Note for existing Melio customers: Nothing is changing until October 27, 2024. You also have access to an exclusive discount for signing up for one of the premium plans. Check your email for details, or see this landing page.

What Bills Can You Pay With Melio

One thing we need to understand when figuring out how to use Melio is what bills are acceptable. You can use Melio to pay just about any other business. However, according to Melio's support page – the service is designed for business to business payments so both entities must be businesses. Some examples of business bills that you can pay are:

- Rent (when your landlord is a business, not individual)

- Taxes

- Utilities

- Legal expenses, Accounting expenses, other professional services

- Contractors / freelance help

- Inventory

- Donations

- Employee reimbursements

This list does not include financial services, because they are not paying a business. That means a car loan, mortgage etc. will not be a payment possibility.

Sign Up For Melio With ToP Exclusive Offer

How to Use Melio: Step By Step Guide

There are four easy steps to pay a bill using Melio.

Step 1

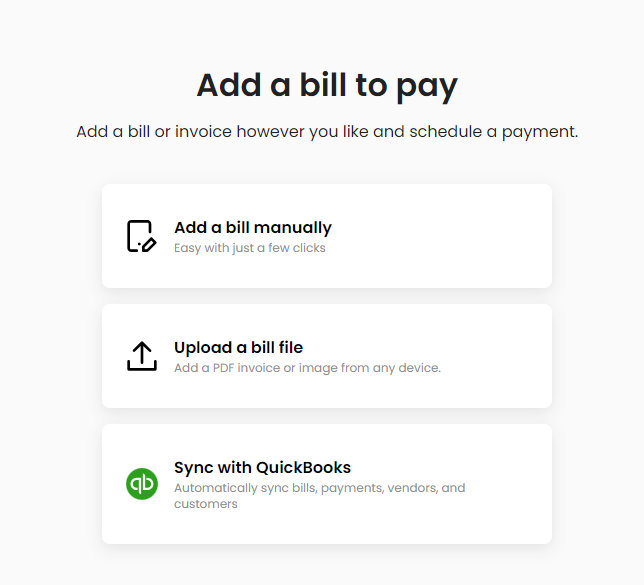

Once you sign in to your account, click add a bill to pay and either manually enter or upload via a PDF bill. You can also sync with Quickbooks to automatically bring in bills.

Step 2

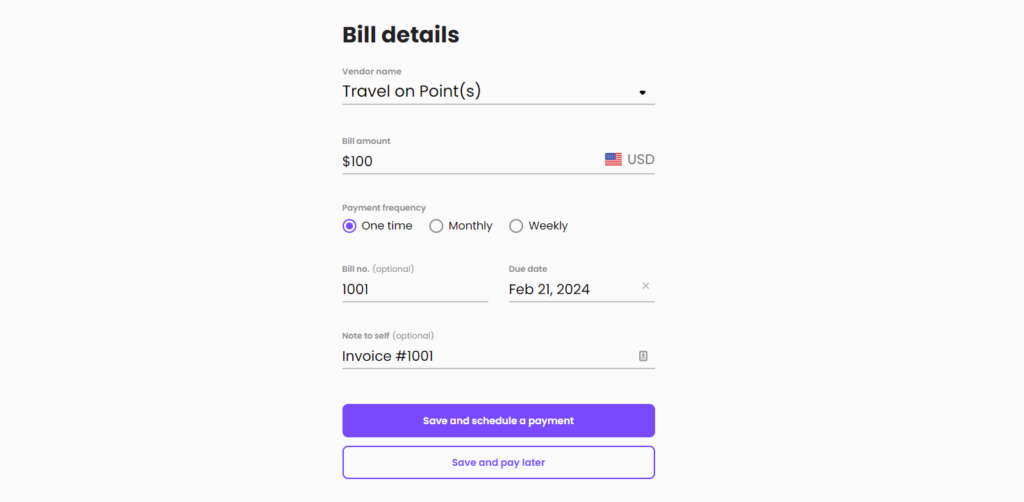

When you insert your bill, you can choose the payee, bill amount, bill number and due date.

Step 3

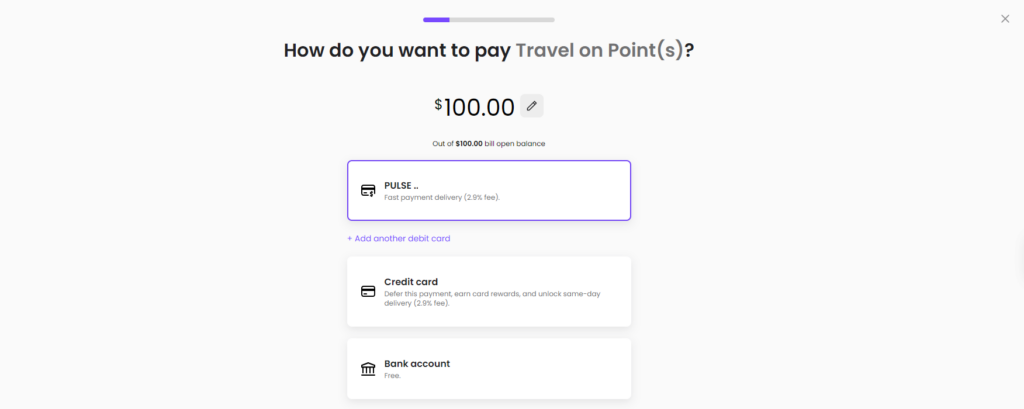

Once your bill in input, you can choose how you want to pay, including the option to use a credit card.

Step 4

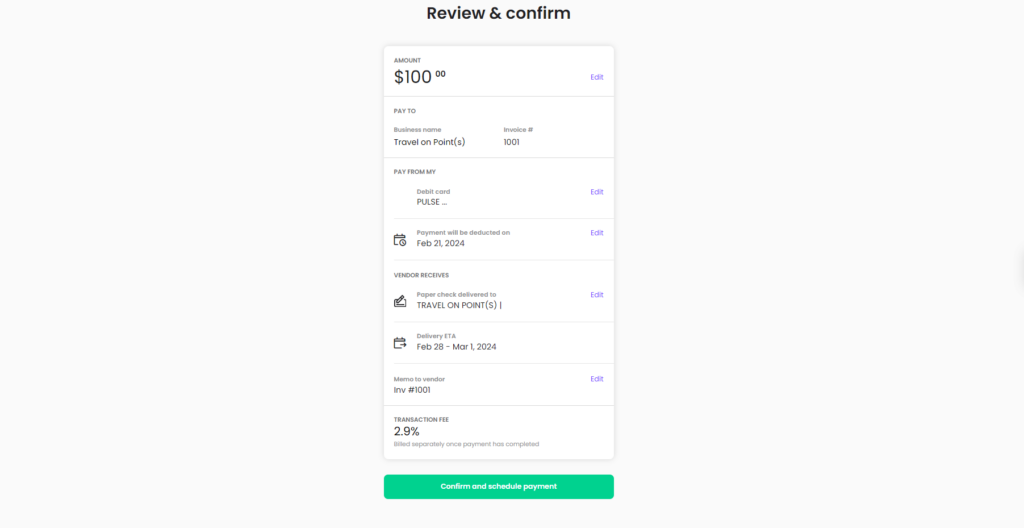

This is the last step, which is to confirm and schedule your payment.

ToP Exclusive Offer

Right now we have an offer available through our referral link from Melio that lets you try the service, and receive a bonus that will more than offset your initial cost, to see if it works for you. The offer is for new accounts only. If you sign up using the ToP link new Melio Go subscribers will get $200 cash back after making a $2,000+ payment via Melio pay within the first 30 days of subscription or new Melio Core or Melio Boost subscribers will get $200 cash back if they do not cancel the subscription before the end of the free trial period. Melio will reach out to finalize the details of your payment.

This is a great way to test out the system if you are quick enough to get in on the deal. Otherwise, I think it is still worth a try to have it in your back pocket should you need it with a vendor. Remember to make at least 1x $2,000+ payment within 30 days of signing up to trigger the Melio Go offer though.

How To Get Set Up For The $200 Payment

After signing up, you will want to add your bank info to your Melio account. Do it as the receiving method so you have a checking account set up to receive payments. Once you meet the bonus criteria, you will then receive an email from Melio saying you are eligible for the $200 bonus and it will tell you to set up your receiving method, or you can share your bank information if you prefer that.

How To Use Melio: ToP Thoughts

Whether you are looking for ways to meet minimum spend, or just wanting to optimize your points earning, Melio can help unlock credit card payments to vendors who do not accept them. While there is a 2.9% fee for card processing, it can be well worth it for a welcome offer or for certain spending offers. Melio is easy to use, user friendly, and an affordable payment solution that is worth checking out. With the ToP exclusive offer, now is the perfect time to give without much out of pocket cost.

Sign Up For Melio With ToP Exclusive Offer

Have you used Melio to pay a bill? Come join the discussion in our Facebook group!